A PONZI SCHEME FOR THE AGES

He claimed that he could profit from arbitraging the difference in "international reply coupons" - a type of voucher used at that time to purchase postage. He organized a company called Securities Exchange Company and sold interests in it to investors promising 50% returns in just 45 days or 100% in 90 days. He took in an astonishing $15 million (over $200 million in today's dollars) in just eight months. However, he neither bought nor sold any coupons and made no profits - but he lived an extravagant life style. In order to perpetuate the scheme, he distributed money from later investors to early investors. After a local newspaper did an investigation of his company and published its findings, outraged investors demanded their money back, the scheme imploded, he went to jail and was deported upon his release. A recent practitioner of this type of fraud was Bernie Madoff who took in billions of dollars from equally greedy and non-inquisitive investors. History will reveal that Ponzi and Madoff were pikers.

Imagine an entity that has sold $34 trillion of "investment coupons" and has to pay $1 trillion in "returns" to existing investors each year. Imagine further that, like Ponzi, it does not invest any of the money it takes in and is only able to pay these "returns" with money that it takes in from later investors. Historically, when belief in an investment scheme begins to fade, existing investors demand their cash back and there will be no new investors. The house of cards collapses and existing investors suffer massive losses.

Of course, we speak of the US Treasury. It is only able to pay off maturing bills, notes and bonds if it continues to take in ever-larger sums of money from new investors. But now the world of major purchasers of Treasuries is beginning to shrink. China, for example, was once a big investor in US Treasuries. It no longer is after the US froze Russia's Treasuries following its invasion of Ukraine. That foolish decision quickly taught the world that being a creditor of the US government comes with huge political risk. Get on the wrong side of the US and watch your financial reserves get frozen - or confiscated - as the US is considering doing with Russia's money, to fund Ukraine's defense.

Investors will soon come to appreciate that US Treasuries also come with investment risk as the world watches the growing insolvency of the US government. This is a chart prepared by the Congressional Budget Office. It reports current and projected fiscal deficits to 2033. Bear in mind that the CBO has historically underestimated the size of future deficits. It will surely be worse than depicted.

In fiscal year (FY) 2023 the US government took in $4.4 trillion in taxes, duties and other receipts. That is a prodigious sum of money. However, it spent $6.13 trillion. 2023 was not an aberration. The US has run continuous "official" fiscal deficits every year since 2002. The Treasury also pays "Off Budget" expenses and those are projected to increase as well. Many economists are penciling in $2T annual US deficits for years to come.

How has the Treasury managed to spend more than it takes in for the last two decades? By selling new Treasuries to non-inquisitive investors and to the Federal Reserve Bank that is able to create trillions of dollars out of thin air. Of course, that led to 9% inflation that the Fed is trying to stamp out with higher interest rates. Its seriousness in following through with that effort was recently put into question when it hinted after its last meeting that it may begin to reduce interest rates in 2024. If it does so and large fiscal deficits continue as expected, inflation is likely to resurge. This brings into sharp focus the wisdom of letting twelve bureaucrats at the Fed micro-manage the enormous US economy. Disaster is virtually assured.

The worrisome and growing US deficits are not stopping Congress from passing legislation to spend ever more money. Examples are the perversely named "Inflation Reduction Act" that will pour billions of taxpayer money into energy to offset Russia's restriction of energy exports to the West in retaliation for the US' economic sanctions, and the CHIPS and Science Act that offers huge taxpayer funded credits and subsidies to the semiconductor industry.

Taxpayer subsidies are always sold to the public as a panacea to a problem that was often created by the government's previous ill-advised interference in and regulation of an industry. Recall, for example, prior taxpayer-funded subsidies to farmers not to produce in order to raise grain prices. Result? Taxpayers first paid the subsidies to the farmers and then paid higher prices for their goods. Today, taxpayers will pay the subsidies doled out by politicians to favored companies to produce "green" electricity (solar, wind) that is more expensive, less reliable and less efficient to produce and then they will pay higher prices for that electricity.

Western Civ Is Rapidly Going Baroque

The final crisis for most indebted nations comes when the "bond vigilantes" (knowledgable large bond investors) refuse to buy the government debt that is on offer. That usually forces the government to offer higher rates to tempt investors (resulting in ever-higher interest costs). In the US, the Treasury has a built-in buyer of last resort, the Fed. But if the Fed is forced to step up, prints trillions, and buy large quantities of Treasuries, it will be "game over." The dollar will crater in value causing prices to soar.

The financial crisis goes well beyond national governments. An astonishing 62% of US citizens are living paycheck to paycheck and over 40% say they could not pay an unexpected $400 expense. They are living on the edge and have piled up $1.3 trillion in credit card debt that carries interest rates around 20% on unpaid balances. If your debt is compounding at 20%, the crisis is not far away. While bankruptcy wipes out debt, it causes creditors such as banks and finance companies to suffer the losses meaning they have less money to lend. As money dries up, rates will rise forcing more stressed borrowers to default as they can no longer roll over outstanding debt at affordable rates.

Banks too are facing crisis. Customers of Silicon Valley Bank rushed for the exits when they heard the bank was trying to raise capital to meet its reserve requirements after Moody's downgraded the bank's credit rating. They quickly withdrew $40 billion. On March 10th, the government seized the bank. Two days later regulators shut down New York based Signature Bank. Then, major banks chipped in to try to bail out First Republic Bank with $30 billion but regulators seized it and sold off its assets to JPMorgan. Internationally, UBS took over its long-time rival Credit Suisse. The following is a chart showing how much money the Fed had to use to bail out banks around the world (half of them foreign banks!) during the last financial crisis. The sums are staggering - almost $20 trillion!

But the biggest skunk in the wood pile may turn out to be bank's derivative bets. A report from Office of the Comptroller of Currency states that JPMorgan has $3.3 trillion in assets and $54 trillion in derivative obligations. Goldman Sachs has $538 billion in assets and $51 trillion in derivative obligations. The top four US banks have $8 trillion in assets and $179 trillion in derivatives. Derivatives, like insurance policies on a home or auto, are simply bets on things going bad and if too many go bad the issuer of the policies fails. Banks often try to hedge their interest rate and bond default risks through derivatives. These are what brought about the 2008 financial crisis and forced the US government to bail out AIG insurance. It was the counter-party to many banks' derivative obligations and AIG was about to go bankrupt due to surging losses on its bets. If AIG had failed, it would have taken many of the major US banks down with it. The only difference between 2008 and today is that total amount of outstanding derivatives is exponentially higher - meaning there is a far greater risk of a systemic implosion should the economy suffer a large hit such as a deep recession and sellers of those derivatives become liable to pay off on the losses. Is the Fed prepared to print $179 trillion to bail out the banks again?

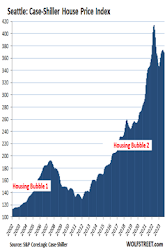

Recall that the 2008 financial crisis came out of the housing market when home prices fell precipitously following an unsustainable price bubble. Below are some charts showing what Wolfstreet.com aptly describes as "Housing Bubble 2." These show housing prices in Chicago, Seattle and Las Vegas. There are similar charts for Denver and Dallas. Banks write mortgages for these properties and if prices crash again, the banks will be dangerously under-collateralized. They did not learn any lessons from the 2008 housing crisis because they did not have to. They were bailed out by the Fed at taxpayer expense and they expect to be bailed out again.

What Is The State of the US Economy?

President Biden is loudly promoting the fiction of "Biden-omics" in an effort to counter polls that have him trailing a man who is charged with over 90 felony counts. He says that the US economy is in rude health. This chart from the Federal Reserve Bank of St. Louis puts that to lie. The black line show the growth of the consumer price index (inflation) and the blue line show the absence of any growth in industrial production. This combination of rising inflation and flat production is referred to as "stagflation."

The next chart shows the ever-declining value of the US dollar (from 2000 to present).

Every worker knows what that chart means: losses in the value of his/her take-home pay. Next is an inflation-adjusted chart showing the loss of average weekly earnings. This is causing ever more financial hardship for most workers - and these workers vote.

"Politicians have got into the habit of spending money like there is no tomorrow, and the population likes it. Sooner or later the bond market is going to throw another tantrum,” said Mark Dowding from BlueBay Asset Management. The IMF predicts US deficits of 7pc as far as the eye can see, pushing public debt to 137pc of GDP by 2028 if nothing is done. Nothing is being done. America is lifting borrowing costs across the world by crowding out the bond markets with debt issuance and roll-overs running at an $8 trillion annual pace. Spillovers have pushed a clutch of countries into the crosshair.

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance. © All rights reserved 2024