HEY MISTER, CAN YOU SPARE $2 TRILLION?

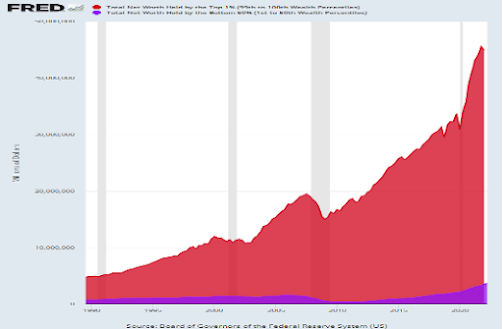

Public office candidates routinely promise more handouts. In the US, Republicans were once the party of small government and balanced budgets but they and Democrats now vie with one another for more "free" benefits. One would think that voters understand by now that they pay for these benefits directly through higher taxes and indirectly through their constantly debased currency - but they do not. Voters are eager to raise taxes on businesses believing that will reduce their tax burden. They have not figured out that all corporate costs (labor, materials, utilities, insurance - and taxes) must be passed on to the consumer or the company will go out of business. Thus, voters pay their personal income taxes and also corporate income taxes. Taxation and inflation are time-honored means by which workers are continually fleeced by their governments. Adam Smith wrote in his 1774 book, The Wealth of Nations, "There is no art which the government sooner learns than that of draining money from the pockets of the the People."

The predictable result of this huge expansion of all governments is that they now find themselves teetering on the precipice of financial disaster. The US Congressional Budget Office reports that the government will spend $1.7 trillion more than it takes in this fiscal year and $2 trillion more than it takes in next year and so on into the future. These deficits will add to the national debt that exceeds $33.5 trillion. The annual interest Uncle Sam must pay on this massive debt now exceeds what he spends on national defense.

Ambrose Evans-Pritchard at the Telegraph adds, Because the US has no monetary reserves set aside from revenues to pay off maturing government debt, it must roll over the low-interest rate maturing bonds (bearing an average interest rate of 2.92%) into new bonds bearing much higher rates (now close to 5%). This chart from FRED (St. Louis Federal Reserve Bank) shows this rapidly ballooning interest cost.

This process can continue only so long as investors around the world agree to step up and buy the vast quantities of Treasury bills, notes and bonds being offered for sale. High interest rates are the fiscal décolletage used to lure buyers to part with their money. Fed Chairman Powell has repeatedly said that rates will be "higher for longer" despite the fact that higher rates ensure ever-higher interest costs. Powell knows that lower rates might lead to a "failed bond auction" where all the Treasuries being offered at auction are not sold for want of interest. That risk grows as debt levels increase and investors become more risk averse. In 2007 the US government debt-to-GDP ratio was 80%. It is now 120%, up 50%, and rising. Federal spending has soared from $4.45 trillion in 2019 to $6.21 trillion in 2023, a 40% increase in just four years. This trajectory is not sustainable.

Following the 2008 financial crisis, the Fed cut interest rates to near zero and printed trillions of dollars in an effort to "stimulate" the economy and avoid a recession. This vast "stimulus" had a predictable consequence. The price Americans paid for the Fed's heavy-handed market intervention was 9% inflation. To combat that evil the Fed then had to rapidly raise rates resulting today in 8% mortgages that are crushing the housing market. They are also boosting commercial loan rates that discourage businesses from borrowing to expand their capacities and hire more workers. These market dislocations are no surprise to real economists (i.e., those not working at the Fed).

Ludwig von Mises observed that the artificial suppression of interest rates by a central bank initiates an unsustainable economic boom by promoting malinvestment. Pushing rates below natural market levels sends a distorted signal to businesses that long-term capital investment is more profitable than the economy can actually support. In the euphoric boom phase, jobs multiply and GDP grows with investment. But many of the investments lack economic merit, so the house of cards eventually collapses.With the liquidation of malinvestments, the bust phase emerges: unemployment soars, output contracts, and a recession begins. Since the investments were built on quicksand, they must unwind. Each failed business further curtails consumer spending, rippling the bust through the economy. But rather than letting liquidation and market corrections occur, policymakers add new stimulus, setting up a larger bubble and more painful bust down the line. At that point, people panic and exchange currency for real assets before rapid devaluation [of the currency] consumes their savings. As the crack-up boom picks up steam, the demand for money plummets while prices of real goods skyrocket, leading to hyperinflation. This psychological shift marks the event horizon where monetary policy is rendered impotent.The crack-up brings the unsustainable, debt-fueled boom to a catastrophic end. Personal savings are wiped out along with the monetary system’s credibility. Society becomes less stable as the populace loses faith in institutions and scrambles for resources. The economy finds its ultimate bottom not in recession but in the total decay of the currency itself. Mises.org

A new paper by four European economists argues that central banks themselves cause “boom-bust dynamics” and financial crises by holding rates too low for too long, then lifting rates too far and too fast. When the next global recession hits in earnest, exorbitant sovereign debt ratios in the US, Europe, China, and Japan will constrain governments from coming to the rescue with adequate fiscal stimulus.

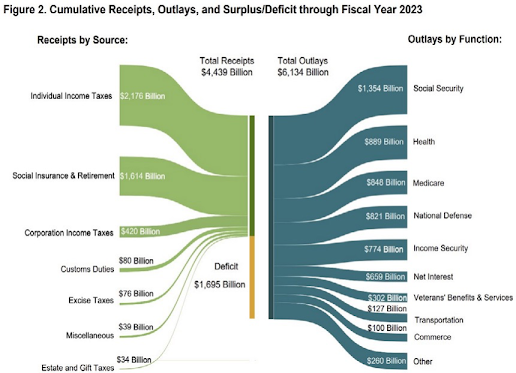

It is almost a racing certainty that central banks will again be forced to mop up budget deficits and to combat debt deflation, first by slashing rates and then by reverting to funny money.We are already well into the "funny money" stage. The Fed has printed trillions of dollars to cover Congresses' ongoing budget deficits. This chart shows the income and outgo for the US. Note the yellow line in the lower center - the budget deficit is almost 40% of expenses.

Source: John Mauldin

Egon von Greyerz cautions,

The Congressional Budget Office confesses these negative effects,The pattern throughout history has always been the same – countries and empires, without fail, become victims of their own success - whether it was the Mongols, Ottomans or the British.As real growth slows, a country starts to finance expansion with debt until it cannot even afford the interest on the debt, never mind the [principal] which it has no intention to repay.

The federal government borrows more each year. That increase in federal borrowing pushes up interest rates and thus reduces private investment in capital, causing output to be lower in the long term than it would be otherwise, especially in the last two decades of the projection period. Less private investment reduces the amount of capital per worker, making workers less productive and leading to lower wages. Those lower wages reduce people’s incentive to work and, consequently, lead to a smaller supply of labor.

Some argue that the simple answer is to raise taxes. The CBO explains why that is not a viable option.

Higher marginal tax rates on labor income would reduce people’s after-tax wages and weaken their incentive to work. Likewise, an increase in the marginal tax rate on capital income would lower people’s incentives to save and invest, thereby reducing the stock of capital and, in turn, labor productivity. That reduction in labor productivity would put downward pressure on wages. All told, less private investment and a smaller labor supply decrease economic output and income in CBO’s extended baseline projections.

The troubles are in public credit, that’s another way of saying there are more bonds on offer than are demanded at prevailing rates of interest and the suppression of interest rates and the distortion that suppression has brought about over the course of more than a decade. To me, that’s going to be the proximate cause of the next financial difficulties, being part and parcel of the next recession. I think gold ought not to trade as an inflation hedge, but as an investment in monetary disorder of which we surely have enough in the world.

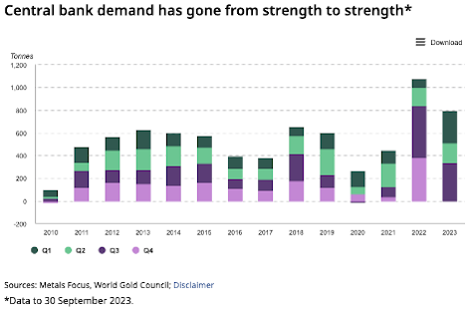

As to his last point, many central banks (not the US, UK or EU) are loading up on gold in quantity. Last year they bought 1081 metric tonnes of it (some 38 million ounces). In the three months through September, they purchased 337 tonnes following 175 tonnes in Q2. Their purchases for the first three quarters of this year total 800 tonnes. They include China, that reports it bought 181 tonnes (likely far more), Poland 57 tonnes and Turkey 39 tonnes. Russia too has been a big buyer following the decision by the US government to freeze the US Treasury assets owned by the Russian Central Bank. No nation wants to run the risk of that happening to them, thus, China, Russia and India's ongoing liquidation of its US Treasuries and purchases of gold. This chart shows these gold purchases, by quarter. Investors might ponder, "What do they know that I am ignoring?"

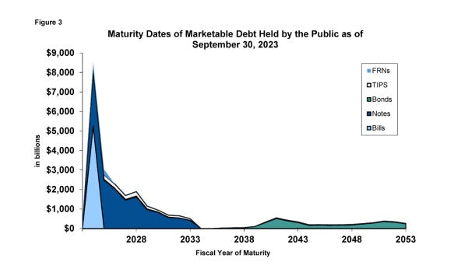

There are many events that could trigger another financial crisis. The US Treasury has $25 trillion of debt outstanding. $15 trillion (60%) mature in the next four years and 82% mature within the next ten years. This chart shows the maturity schedule. What is unknown is the demand for this huge glut of Treasuries that need to be refinanced. Big supply and low demand is the Treasury's nightmare.

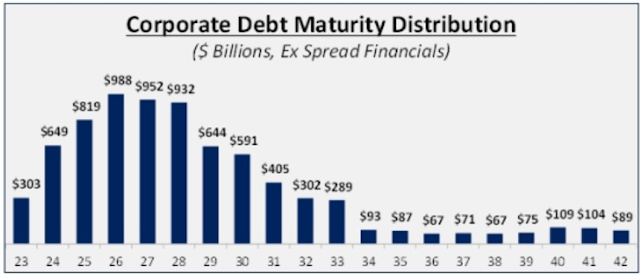

In addition to the $7 trillion of US government debt that will mature in the next twelve months and must be rolled over, there is also $13 trillion of corporate debt - with the largest sums due over the next seven years. Next year's maturing corporate debt will be more than double this year's and most of the new loans will bear interest rates more than double that of the maturing loans. This increased financing cost ensures ongoing pain for the businesses and, of course, their customers who will pay higher prices for their goods and services.

There is also the matter of the US's un-budgeted costs to support two foreign wars. US Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell and President Biden assure Americans that there is "no problem" with the US being able to financially support Ukraine in its war with Russia and Israel in its war with Palestine, even though, a) the US is running continuing multi-trillion dollar budget deficits, b) the Fed is sitting on unrealized mark-to-market losses of over a trillion dollars on its Treasury and mortgage backed securities holdings, and c) the Bureau of the Budget estimates the US national debt will soar to $43 trillion by 2033 and interest costs on that debt being "higher for longer."

"No need to worry," voters are told, because the US economy is in rude health, recently hitting 4.9% annualized growth of GDP. It is worth taking a peek behind the curtain to see what is really going on. While it is true that increased productivity can help keep an economy ahead of price inflation, this chart shows that is not the case for the US. The black line is CPI inflation and the purple line is industrial production - the latter of which remains at 2019 levels.

Voters are also told that there is no need to be concerned about the consumer blow-out spending seen in this chart,

or skyrocketing credit card balances (now over $1 trillion bearing interest of up to 25%). Officials insist this is not a problem because US wages are rising. However, data from FRED refute that. This chart reports "inflation-adjusted" average hourly earnings through June of this year. Wages are still negative - that is, workers continue to lose purchasing power - not gain it. Bear in mind that this chart uses the Fed's "16% Trimmed Mean" inflation calculation that significantly understates real price inflation. (See, e.g., inflation data at Shadowstats.com)

Voters are also told that employment is surging, proving the strength of the US economy. David Stockman assesses this claim,

Since April 2023 the headline jobs count has allegedly risen by a robust 1.234 million, according to the ballyhooed establishment survey. But the number of people actually employed has only increased by 191,000, according to the BLS [Bureau of Labor Statistics] household survey. You don’t need to be either an economist or statistician, however, to understand that each of these 191,000 newly employed Americans were not holding down 6.5 jobs each!

Political leaders and the Fed also tell you that the rate of inflation is ever closer to the 2% goal and thus, consumers will soon be saved from the ravages of price inflation. To begin with, the Fed's 2% inflation rate is not a worthy goal. Inflation continuously steals money from both workers and savers. It is the means by which the government relentlessly transfers wealth from the people to the government to spend as the insider elites direct - largely to themselves in the form of bank and corporate subsidies and bailouts. This chart reports the (government calculated) annual rate of inflation since 2011. It shows that the rate of inflation has decreased from it recent high. That looks like good news.

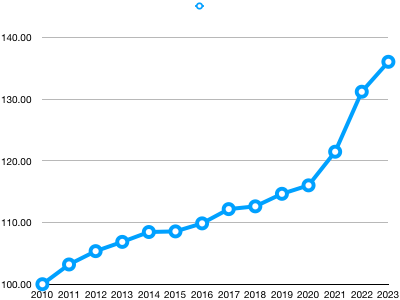

However, even if price inflation eventually returns to the Fed's 2% goal (no certainty), the damage you have suffered - and will continue to suffer - is not eliminated. The next chart shows the cumulative effects of inflation on the prices of goods and services. High prices do not go away when the rate of inflation subsides - they remain baked into the cake. What cost $100 in 2010 now costs over $135. That is another way of saying that the purchasing power of your dollar has declined by 35% in just twelve years. This is why so many people are struggling to make ends meet.

Prices Have Not Returned To Their Former Levels

The essential point is that the Fed will never succeed in bringing down price inflation so long as Congress continues to run huge budget deficits that the US Treasury must cover with ever more bond sales. Paul Krugman, a well known liberal economist, is becoming alarmed at the US's fiscal direction. He was recently quoted saying,

In a better world, we’d be taking action to bring interest rates down in a sustainable way. In particular, now would be a good time to rein in budget deficits. However, the chances of serious action on the deficit anytime soon are near zero.

We agree with Mr. Krugman that there is absolutely no appetite in Congress to be fiscally responsible - and there has not been for more than twenty years. At best, Congress will tinker around the edges pretending to trim expenses but it will not take any serious action to stem the spending hemorrhage until the next financial crisis is upon us - and it may not act then, hoping to avoid being voted out of office if benefits must be reduced.

The US is not the only country facing this crisis. Anyone paying attention can identify comparable problems in their country. For example, the UK will issue bonds in the amount of 241 billion British pounds this fiscal year - with almost half of it going to service the interest on existing debt. Whether the next crisis comes in six months or six years is unknowable. As set out above, the US national debt will soon be $43 trillion and the interest on that debt will be staggering. Because governments have no savings set aside from tax collections and continuously spends more than they take in, this leads to one inescapable conclusion: because their debt cannot be honestly repaid, it will not honestly be repaid.

There will be pressure to substantially increase taxes on "rich corporations." Of course, doing so will crush the economy as money to pay wages and expand businesses will be lost to taxes. That will lead to higher unemployment as businesses struggle to lower their costs. It will also force up the price of goods and services because corporate taxes must be passed on to consumers. Price controls might then be proposed even though history convincingly proves that such controls always lead to shortages of goods. Governments' final act will be to print massive sums of new money to cover soaring social welfare and interest expense costs.

Debasing currencies is the time-honored way for governments to reduce their debt burdens. But this causes the currency to lose value rapidly and leads to a host of new problems. It is the classic act of desperate governments. Recall the French assignat issued in quantity during the French Revolution and massive German mark printing following World War I. Both currencies became worthless. So too did Zimbabwe's "one trillion dollar" paper currency notes. Today's Argentine peso is heading in the same direction due the country's 150%+ annual inflation rate resulting from massive government money printing. Debasing the national currency is immoral because it always hurts savers, those living on a fixed incomes and the poor the most. But it is the price that the government insider-elite are willing to make you pay in order for them to stay in power.

When the inevitable crisis arrives, the government can declare a "payment holiday" on its debts. Regardless of what they call it, everyone knows that is a "default." The nation's credit rating would be crushed and it would struggle to sell new government obligations because no one would be so foolish as to buy them. In response, it might then declare a "national emergency" and direct that all cash held in banks and retirement accounts be "invested" in government bonds, "to protect investors." The message to take to heart is that desperate governments do desperate things. Things you would not have believed could happen before the crisis will happen during the crisis. Of course, none of these actions solve the problem - they simply shift the loss to someone else. In all defaults, creditors suffer the losses. You want to avoid being your government's creditor when that time comes. Bill Bonner explains why,

The force of a correction is equal and opposite to the delusion that preceded it. Given that the jackassery of the last 23 years was unprecedented in US history, we can imagine that the correction will be also unparalleled.

Who is to blame for this debacle? The answer is: our high government officials. Who elected them? We did. Why have they acted so irresponsibly? We urged or allowed them to do so. It has been wryly observed that the interesting thing about democracies is that the people end up getting the governments they deserve.

But there is more. Consider: what if the next financial crisis comes in conjunction with another crisis such as: the failure of the national electric grid during an uncommonly hot summer, hurricanes, tornados, flooding, riots in major cities, another pandemic, the mining of the Straits of Hormuz eliminating oil imports, China invading Taiwan, etc? Assuming that crises come only one at a time is a high risk bet.

Anticipating this, some investors are asking themselves, "How can I protect myself, my family and my assets?" If you think that being overweight in stocks is the answer that will protect you from lower rates, more money printing and higher inflation, consider the wisdom of Warren Buffett. His famous admonition is to "be greedy when others are fearful and fearful when others are greedy." That makes obvious sense. Buy assets when prices are down due to generalized market fear, and not when they are elevated. He looks to the ratio of the growth of GDP to equity prices to determine if stocks are over-priced and to be avoided or under-priced where you should be loading up on them.

Here is a recent chart of what is known as the "Buffett Indicator." It shows that equity prices remain well above trend and are therefore overpriced. This does not mean they cannot become more overpriced. They well might, but the risk of loss when buying overpriced stocks increases. If you are in or near retirement, this is not the time to be overweight stocks. Take particular note that Buffett has been a net seller of some $40 billion of securities this year and holds a record $157 billion in cash. This tells us that he and Charley Munger are not finding suitable stocks to buy. So too, Jaime Dimon is selling off a huge chunk of his JPMorgan shares.

But there is more. Consider: what if the next financial crisis comes in conjunction with another crisis such as: the failure of the national electric grid during an uncommonly hot summer, hurricanes, tornados, flooding, riots in major cities, another pandemic, the mining of the Straits of Hormuz eliminating oil imports, China invading Taiwan, etc? Assuming that crises come only one at a time is a high risk bet.

Anticipating this, some investors are asking themselves, "How can I protect myself, my family and my assets?" If you think that being overweight in stocks is the answer that will protect you from lower rates, more money printing and higher inflation, consider the wisdom of Warren Buffett. His famous admonition is to "be greedy when others are fearful and fearful when others are greedy." That makes obvious sense. Buy assets when prices are down due to generalized market fear, and not when they are elevated. He looks to the ratio of the growth of GDP to equity prices to determine if stocks are over-priced and to be avoided or under-priced where you should be loading up on them.

Here is a recent chart of what is known as the "Buffett Indicator." It shows that equity prices remain well above trend and are therefore overpriced. This does not mean they cannot become more overpriced. They well might, but the risk of loss when buying overpriced stocks increases. If you are in or near retirement, this is not the time to be overweight stocks. Take particular note that Buffett has been a net seller of some $40 billion of securities this year and holds a record $157 billion in cash. This tells us that he and Charley Munger are not finding suitable stocks to buy. So too, Jaime Dimon is selling off a huge chunk of his JPMorgan shares.

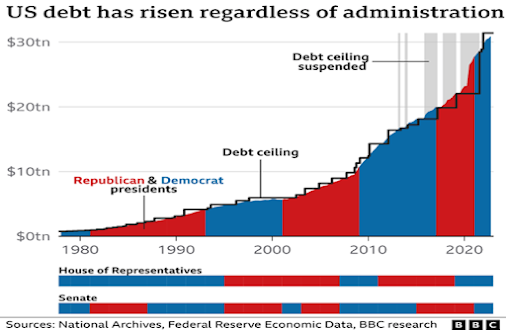

Next year is an election year in the US. Will a political party change solve the problem? Short answer? "No." Republicans are just as big spendthrifts as are Democrats. David Stockman, Ronald Reagan's former budget advisor, writes,

The GOP has utterly and completely abandoned its core mission in the tussle of democratic governance. It should be the party of peace, liberty, free market prosperity and financial sobriety in opposition to the profligate “Government Party” of the Dems. Yet the GOP has been hijacked lock, stock and barrel by political crusaders bent on using the power of the state to impose their own sectarian values, ideologies and theories of societal betterment on a nation that is already badly over-taxed, over-governed and over-edified by Big Government and its Nanny State factotums.

Proof of this point is this chart showing the growth of US government debt since the late 1970's. Both parties are "guilty as charged."

We have no crystal ball or magic tea leaves that allow us to predict the future. However, it is clear that our governments have been badly managed for a very long time and there will be a stiff price to pay for that. You would be well advised to give some thought now to how you might rig for future stormy weather. Some assets will survive the next crisis; others will not. Please note: we are not suggesting that equities be abandoned - although some conservative investors may take that approach. What we suggest is that you evaluate your holdings today in an effort to identify their exposure to future political and financial risks. We subscribe to Weiss Ratings (weissrating.com). It has an impressive history of assessing bond and equity risks and has been recognized by both Barrons' and the Wall Street Journal as being one of the best rating services. We also use Value Line. We receive no benefits for mentioning them. Feel free to use them, some other rating service or your personal financial advisor. One thing to avoid is doing nothing assuming everything is going to work out in the end. It might but you may not enjoy the ride.

A Final Thought

Thomas Jefferson recognized "public debt as the greatest of the dangers to be feared" and that "the principal of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale." Today's massive government debts are the result of decades of such swindles. Your children and grandchildren will bear the brunt of that financial burden and will not thank you for it.

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance.

© All rights reserved 2023 However, no copyright is claimed in quotes, charts or data from public or private sources.