REALITY BITES

Having lived through a reality-optional period of history, it will come as a shock to learn that the world requires us to pay attention to what is really happening and to act accordingly.

Reality Number One

Year Over Year Inflation Rate

The viewer is led to believe that the damage done to the economy by the heavy dose of inflation has been successfully reversed. That is not close to reality. The long-term effects of inflation have not been eliminated but instead have been permanently baked into the economy's cake as the next chart shows.

The flip side of price inflation is currency devaluation. The money we struggle to save for our retirement and emergencies is being constantly debased. Who is responsible for this travesty? In the US it is our elected (Congress) and unelected (Fed) officials. The cumulative result of this ongoing devaluation is staggering. This chart shows the shocking fall in the value of the US dollar. It has lost 97% of its purchasing power since the Fed was created and over 80% since the early 1970's. What can we learn from this chart? That saving in dollars is a fool's game. Your dollars are guaranteed to lose massive purchasing power by the time of your retirement. We can hope that Congress and the Fed will stop doing what they have been doing and reverse this 100+ year trend of debasing the dollar. But will they? Congress continues to try to buy your vote with promises of ever larger benefits - as if they flowed from a cornucopia. They neglect to mention that those benefits come out of your pocket through direct taxes and, insidiously, the indirect tax of inflation.

US Dollar's Loss of Purchasing Power

It should be evident by now this is not going to reverse and is instead almost certainly going to get worse. The US government continues to spend substantially more than it receives in revenues: $4.2 trillion more in 2020, $2.8 trillion in 2021, $1.4 trillion in 2022, and $1.4 trillion so far this fiscal year (that ends in October). The next chart shows projected deficits for the coming ten years. As bad as it is, this is an optimistic assessment because it does not take into account unforeseen future "emergencies" like the Great Financial Crisis of 2008, the Covid Crisis and the recent Banking Crisis that caused multiple banks to fail (e.g., Silicon Valley Bank) and the enormous cost to the government in addressing those crises.

These budget shortfalls largely have been paid with newly printed dollars that diminish the value of existing dollars because no goods or services were created in exchange for them. As Jim Grant says, they were simply "whisked into existence" by the Fed.

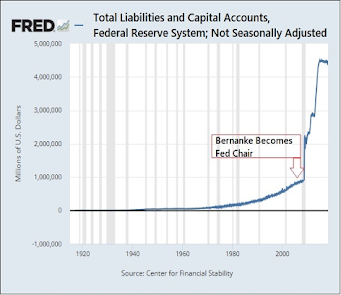

This chart shows the rapid increase in the Fed's capital accounts (liabilities) since Ben Bernanke had "The Courage To Act" (print money with abandon) while he was head of the Fed.

Source, Wolfstreet.comFrom June 1960 to August 1990, the Fed’s balance sheet increased from $53 billion to $309 billion – an increase of 483 percent in 30 years. But during the tenures of Bernanke, Yellen and Powell, the Fed’s balance sheet has exploded from $805 billion in February 2006, when Bernanke took his seat as Fed Chair, to the current reading last Wednesday, July 19, 2023, of $8.3 trillion. That’s an increase of 931 percent in just a little over 17 years. What QE essentially boiled down to was the Fed artificially driving down interest rates by creating artificial demand for debt securities, which it bought by trillions of dollars and parked on its balance sheet. Beginning with Bernanke and his rollout of QE, the Fed morphed from lender of last resort to federally-insured banks (its mandate under the Federal Reserve Act) to buyer of last resort for what Wall Street regurgitated (not its mandate anywhere to be found in the Federal Reserve Act).

The US has not had an annual current account surplus since 1981 - forty-two years ago. Since then it has been "lights out" for deficits. You cannot run your household like this, your town cannot do so, nor can your state. What would lead you to believe that your national government can carry on like this without consequence?

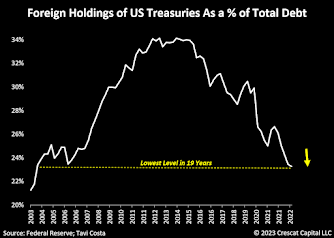

The US government can raise money two (honest) ways: a) collect more taxes from its citizens, and increase tariffs and fees, and b) raise money through the sale of Treasury bills, bonds and notes. In order to attract buyers of Treasury debt, the offered rate of interest must be appealing. The downside is that as interest rates go up, the cost to the Treasury soars - causing it to have to sell ever more Treasuries.

One Solution For Inflation - Increase Your Country's Productivity

One way to lift oneself out of an inflationary black hole is to become dramatically more productive. Doing so makes your products more desirable on the international market because they can be produced more cheaply. How is the US managing on the productivity front? David Stockman reports,

The industrial production index for June posted this morning at 102.25, which is neither here nor there except for this spot of historical comparison: To wit, this same index posted at 102.26 way back on the eve of the Great Financial Crisis in December 2007.

That’s right. After 15.5 years of the greatest burst of continuous fiscal and monetary “stimulus” the world has ever seen, US industrial production has changed by zero, nichts, nada, nothing. And to the second decimal point. The industrial production index is no johnny-come-lately, marginal data dump based on dubious inflation-adjustments, imputations and modeled guesstimates. To the contrary, it is probably the oldest, consistent US time-series and is based on physical measures which don’t change—barrels of oil, kilowatt hours of electricity, tons of steel, units of assembled autos etc.

Stated differently, this index encompasses the entirety of the US industrial economy—manufacturing, utilities, energy and mining—and it hasn’t gone anywhere for a decade-and-one-half.

Another solution to stem inflation is to stop increasing the money supply. Simple, elegant, will not happen.

Inflation Enriches the Few at A Cost To the Many.

For all practical purposes money is a stand-in for your labor. When you work for a week, your paycheck is the exchange for your labor. Thought of this way, your savings over time represent your stored former labor. Inflation erodes the value of that labor. Since 1971 the US dollar has been devalued by more than 80%. If you are near or in retirement, this means that years of your prior labor, that you thought you were diligently saving, have been confiscated. Yet, inflation does not hurt everyone equally.

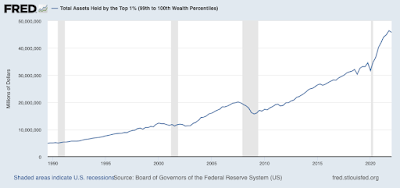

Those who own particular types of assets can benefit from inflation. That is because asset prices are bid up by those in a financial position to do so in an effort to avoid inflation's impact. Owners of real estate, stocks, art and other hard assets can benefit from inflation while the average worker struggles with it. We can see this graphically in the following two charts. The first reports the growth of wealth of the top 1%.

There are two types of money. The first is "hard money." It is so-called because it is backed by real assets such as gold or silver - commodities that people have held in high regard throughout time. The second is "fiat money" so-called because a government has decreed it to be money. These are backed by nothing more than "the full faith and credit" of the issuing government. With regard to the former, a government can collapse or be defeated in war and its money will still have value recognized around the world. With regard to the latter, if a government collapses, its money is very likely to lose all of its value. History is filled with failed fiat currencies - hundreds of them. But it is also filled with former hard currencies that have retained their value to this day. Examples are the ancient Roman denarius silver coin, US $20 gold coin, British gold sovereign, South African gold Krugerrand and Mexican gold 50 pesos coin. They are all still prized these many years later because they have value that is extrinsic to the issuing government.

Today, all currencies in general circulation are fiat. If you want to value a dollar, ruble, yuan, euro or Swiss franc you typically compare it to the value of another fiat currency. For example, the dollar can be up or down in value against the euro. Both currencies fluctuate constantly based on the strength of their economies, the world economy, political upheaval and many other other factors. Both lose purchasing power constantly. A more sensible way to value a fiat currency is to compare it to the price of gold - which has a more than 5000-year history as a reliable store of value.

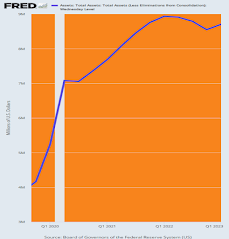

There is one certainty you can bank on: all fiat currencies including the dollar will be printed to excess by irresponsible governments and thus will be continuously debased. While twenty 1913 US paper dollars now have just sixty cents in purchasing power, a 1913 $20 US gold coin is worth about $2,300.00 today. There is no hard currency in general circulation today that you can acquire to protect your savings from inflationary confiscation, but you have a very simple option. You can buy gold coins. A number of national mints coin gold today (not for general circulation) including the US, Canadian and Australian mints. It is true that gold continues to be mined and thus increases in quantity but it does so at a very moderate rate. It costs a great deal of money, expertise and labor to mine, refine and coin an ounce of gold. It costs next to nothing to print another thousand $100 US Federal Reserve Notes and nothing at all to add trillions of them electronically to the Fed's balance sheet as was done in vast quantity over the last four years as this chart shows.

An interesting corollary to the earlier chart showing the ever-declining purchasing power of the dollar is this next chart showing the ever-increasing rise in the price of gold. To be sure, it is not a straight line up but it has left the dollar (and your fiat currency) in the dust. The price of gold, like all commodities, is affected by supply and demand. However, it follows an historic inverse relationship with the falling value of all fiat currencies.

Source: MacroTrendsThe truth is that gold has not increased in value. An ounce of gold is still just an ounce of gold. There is nothing new or "high tech" about it. Rather, the dollar (and other fiat currencies) have lost almost all of their value. So, if you need to save one or the other (dollars or gold) for your future retirement, what does history convincingly prove to be the better choice?

Yes, we know that the Fed and many "prominent" economists publicly deride gold as an "anachronism." But they do so for the purpose of preserving the fiat money status quo that continues to enrich them and the insider elite at the expense of the working classes. It is no surprise that these same naysayers of gold remain hushed about fact that central banks have been big buyers of gold. In Q1 they set a record buying 228 metric tonnes of it and last year they bought 1,136 tonnes. Russia and China are now the biggest producers of gold. Would they be intently acquiring it in vast quantities if gold is a useless relic of the past? They do so because they know during a financial meltdown, when their fiat currencies are collapsing, they can use it to support their failing currencies or back a newly issued one. Russia, China and India are also stockpiling it to avoid being punished by future US financial sanctions that could freeze their dollar holdings. This chart shows that Russia has rapidly off-loaded US Treasuries - deeming them to be a toxic asset.

Conclusion

This chart shows the debit side of the US government's balance sheet. It is not pretty and is certain to get worse. Debt has risen by 50% in just the last five years. History convincingly demonstrates that there are painful consequences for national fiscal imprudence. The only uncertainty is whether they come sooner or later. The pressing question is do you want to be left holding dollars (or any fiat currency) when that time arrives?

.png)