Hu Pill, chief economist at the Bank of England recently told Britons that they need to accept that they're worse off and stop trying to maintain their real spending power by asking for wage hikes. BOE governor Andrew Bailey seconded this message adding that salary increases will feed through to higher costs due to "second round effects" and workers' demands for higher wages are frustrating his efforts to combat rising costs. Brits are poorer due to price inflation's impact on food, energy, housing and nearly all other goods and services. At bottom, the bankers' view is that workers, who are the biggest victims of price inflation, should bear its cost and quit carping. Needless to say, that has not gone over well.

The essential fact is that workers did nothing to cause prices to rise. Nurses at the National Health Service, trainmen for the National Rail service, and workers for Royal Mail show up for their work shifts, tend to the ill, run the trains and deliver the mail. That is to say, they do their jobs. Yet they have disproportionately borne the heaviest burden of price increases. The well-heeled barely notice rising food, energy and housing costs. The middle and lower classes are devastated by them. For the BOE to chastise them for demanding raises to meet rising prices is not only heartless, it is dishonest. As economist Milton Friedman famously wrote, price inflation is "everywhere and always" a monetary phenomenon, meaning that it results from a rapid increase in the money supply. UK workers are not guilty of that crime. The Bank of England is the culprit. When there are more pounds sterling chasing available goods and services prices go up. This is not rocket science, it is basic economics.

Kate Andrews at the Telegraph recently took the BOE to task for its blame shifting,

It’s far more likely that the hundreds of billions of pounds of money-printing that the Bank undertook during the pandemic (printing more money in the first year of Covid than it did in the decade running up to it) is the primary cause of inflation, not pay increases. As the Cato Institute's Ryan Bourne rather succinctly summed it up last year, targeting wage growth as the problem after record expansion in the money supply is akin to “lamenting gravity as the cause of hurtling to the ground after someone has thrown you from a plane”. Today’s wage increases fall behind the rate of inflation. Those 7pc pay boosts on average are being eaten up by price hikes. So wages, in real terms, are falling: your average worker is actually feeling 3pc worse-off.

The chart below shows the rapid increase in the BOE's assets that were purchased with money printed from thin air. This monetary growth well exceeded the growth of the nation's GDP.

This chart shows the rise in price for UK food products.

After causing rampant price inflation, those in government are eager to step into the fray once more with a new "cure" for what ails the nation. They are toying with the idea of imposing price controls on food - proving beyond any reasonable doubt that they are economic illiterates. Jeremy Warner at the Telegraph,

What has become of our politics that the Government’s first response to an inflationary shock is to reach for the tried and failed solution of price controls? We road tested price controls in the 1970s, also under a Conservative Government when Ted Heath established the Price Commission; they didn’t work then, and they won’t work today. "We economists don't know much, Milton Friedman said, "but we do know how to create a shortage. If you want to create a shortage of tomatoes, for example, just pass a law that retailers can't sell tomatoes for more than two cents per pound. Instantly you'll have a tomato shortage. It's the same with oil and gas." If government tries to control pries, you end up with empty shelves, and a thriving black market where prices are twice as high as otherwise.

Housing is another source of pain. Some 2.5 million homeowners have short-term, fixed and variable rate mortgages coming due over the next two years. (While the 30-year fixed-rate mortgage is common in the US it is unavailable in much of Europe. Five-year terms are common). It is estimated that Brits will spend an additional nine billion pounds in 2023 and 2024 when they are forced to refinance at rates that are double what they were. Another housing problem is that 250,000 homes are needed to accommodate the record number of migrants who have entered the country both legally and illegally.

Thankfully, overall UK inflation has dropped from 10.1% in March to 8.7%. That is a step in the right direction but workers are still stressed as their wages continue to trail inflation. They are forced to consume their savings or increase their credit card debt. Demanding that they forego wage hikes is not the solution. The answer is to cease expanding the money supply so that prices can stabilize. Then excess money can be withdrawn from the economy. Would doing that be painless? Of course not. But continuing to print money recklessly is guaranteed to lead to disaster. Ask those who lived with German hyperinflation, or currently struggle in Venezuela, Argentina (where inflation is expected to reach 145% this year), Turkey (85.5% inflation last year) and Zimbabwe. The fact is that government officials will never do what is necessary to stem price inflation because they fear they would be voted out of office as bad debt is wrung from the economy. History demonstrates that returning to a sound currency only follows a collapse of the existing monetary system - as in post-war Germany. Without a return to sound money the middle and lower classes will continue to lose purchasing power and become increasingly impoverished. That leads to growing public anger, often followed by political and social upheaval.

England is not the only county burdened with massive government spending leading to rising prices. France is the most bloated government in Europe with public spending consuming more than half of national GDP. That is not sustainable and the credit rating agencies have taken note. Fitch downgraded France's credit rating to AA- putting it into league with the Czech Republic and Estonia, causing it to have to pay higher interest on its bonds. France's total government debt to GDP is 112% and rising. Macron forced through a rise in the retirement age from 62 to 64. That was massively unpopular and caused huge protests. While that was a start, it is a long road before France reaches a state of fiscal probity. This is a problem throughout the world. People and businesses have become addicted to government benefits, bailouts and subsidies but are unwilling to pay enough in direct taxes to support them. What most citizens do not understand is that they pay for them through the indirect "inflation tax" that results from their currency being debased by money printing.

Germans, and their industries, now suffer the continent's highest energy costs. Following their loss of access to cheap Russian natural gas, they have been forced to import expensive liquified natural gas. If that was not enough to stagger the economy, they then decided to close their last three nuclear power plants insuring rising electrical energy costs. Now they are in the process of dictating the replacement of gas furnaces with expensive and inefficient heat pumps. Jeremy Warner observes that, "like a lot of well-intentioned public policy, the collision with reality is proving nasty, brutish and long-lasting." To meet peak (and perhaps ongoing) demand for electricity, Germany is forced to rely on its coal burning plants.

The US Struggles With the Same Issues

While the Fed raised the Federal Fund Rate to 5.25% in an effort to stem the inflation it created with its massive money printing and negative real interest rates, that Fed fund rate is not what it seems. When one accounts for the rate of inflation, interest rates are still negative. The chart below shows the Fed fund rate less the Fed's preferred "sticky" inflation rate. The real Fed funds rate is -1.5% and thus, still very accommodative, not restrictive. The Fed's "Taylor Rule" (ignored in the main) holds that real rates must be at least positive 2% to combat price inflation. If rates were to stay at that level the US economy would likely tank because it is so over-leveraged (indebted).

The ten-year Treasury rate is even deeper in real negative territory. This rate is fundamental to the US economy for long term financial planning and it continues to give erroneous signals to the marketplace.

Largely ignored by the main stream media is the Treasury's imminent need to flood the market with $1T of new bonds that it must sell quickly to pay accumulated government debts and ongoing expenses. This amount of new debt is likely to force rates even higher causing more pain to the economy especially for highly indebted companies and people trying to secure mortgages to buy homes. There will necessarily be a "crowding out" in the market place as the Treasury competes with all others who are in need of new financing or must roll over existing debt - such as owners of commercial real estate, like office buildings, that are suffering historically low occupancy rates. The Treasury's new bond sales will add to the mountain of its existing debt. This chart below shows the surge in US national debt from $21 trillion in 2018 to the current $32 trillion - an increase of 50% in just 5 years. The Congressional Budget Office estimates that this debt will reach $50 trillion within ten years.

Source: Wolfstreet.com

Below we see the soaring cost of servicing that debt - meaning that an ever greater portion of tax revenues will be consumed by this interest expense leaving less for all other programs. The government's "solution" for this dilemma, will be to print more money - ensuring further debasement of the currency and more inflation. Two other options are raising taxes or cutting expenses substantially. It is our view that taxes could be raised but not enough to cover government expenses. That ensures the third, and favored option, printing more money.

Source: Wolfstreet.com

Underfunded Government Benefits

Social Security Retirement and Disability Insurance are further claims on the national budget. A growing problem is that the ratio of workers-to-retirees continues to fall. That ratio was 5:1 in 2000 but it is expected to fall to just 2.5:1 in 17 years and continue to decline thereafter. That means less money coming into the system while expenditures soar as the number of retirees continues to rise.

Source: David Stockman

The fundamental problem with the Social Security system is that the money collected from participants throughout their working lives is far less than the lifetime benefits paid to them. Stockman shows why the system as it is designed is doomed. The numbers in bold are the multiples of benefits paid over contributions made.

Contributions v. Benefits

Single Low Wage Worker: $195,000 vs. $481,000=2.46X;

Single Ave. Wage Worker: $434,000 vs. $615,000=1.41X;

Single High Wage Worker: $694,000 vs. $725,000=1.04X;

Married Couple, One Low Wage Worker: $195,000 vs. $934,000=4.79X;

Married Couple, One Ave. Wage Worker: $434,000 vs. $1,162,000=2.68X;

Married Couple, One High Wage Workers: $694,000 vs. $1,348,000=1.94X;

Married Couple, Two Ave. Wage Workers: $867,000 vs. $1,303,000=1.50X.

Social Security pretends to be an "insurance" program but it has never engaged in any "underwriting" - that is, determining the real cost of the program and building those costs into the premiums collected. While the rate of compelled contributions may be raised as the crisis unfolds, over vociferous objections by workers, those contributions will never fund the whole cost of the program. If benefits are meaningfully reduced to meet available funds, there will be an insurrection - so that will not happen. This too ensures further debasement of the currency to pay for the program, ensuring future price inflation.

The Never-Ending Banking Crisis

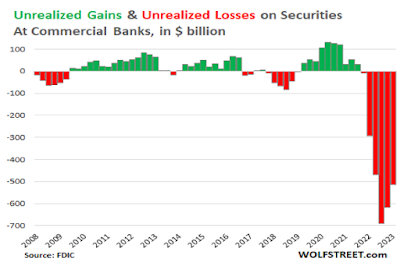

Is the US banking crisis over? Not likely. This chart show the amount of unrealized losses (in hundreds of billions of dollars) that banks have suffered on their US Treasuries and mortgage backed securities holdings due to the Fed raising interest rates causing the price of low interest bonds to fall in value.

The second, third and fourth largest bank failures in US history occurred this year. What was not reported is that none of these banks was on the Fed's "Problem Bank" list that it prepares quarterly. Who was supposed to be keeping an eye on these banks? It was the San Francisco Federal Reserve Bank and FDIC. Several months before the crisis the FDIC reported that just $47 billion were housed at "Problem Banks." The three failed banks had over half a trillion dollars in bank assets. How did these regulators miss this developing crisis? Clearly, they are not up to the task of meaningfully regulating the banks.

Another issue facing banks (insurance companies and hedge funds) is the crash in value of commercial space that secures the loans written on those properties. Blackstone just walked away from its ownership on a 26 story tower in Manhattan as commercial property prices fall. A 22-story office tower at 350 California Street in San Fransisco that was previously valued at $300 million just sold for $65 million. Other properties in San Fransisco have lost up to 70% of their purchase value. Brookfield Corp. defaulted on $161 million floating rate mortgages on a group of office buildings in the Washington D.C. area where the occupancy rate has fallen 52%. Columbia Property Trust defaulted on $1.7 trillion in loans on buildings in New York, San Francisco, Boston and Jersey City. Vacancy rates in Los Angeles, San Francisco, Silicon Valley, and Seattle have risen to 20-30%. When losses on those properties are realized through sale, their new buyers will be able to attract tenants from other properties by charging lower rent due to their now lower cost. That will cause more vacancies in properties that have not yet changed hands. Work-from-home has crushed commercial property as businesses realize they have far too much space. Banks hold 45% of commercial real estate mortgages totaling $2.25 trillion.

The US "Debt Ceiling"

Many people are elated that the US debt ceiling crisis is over. There was much fear-mongering that the failure to increase the debt limit would cause the US to default on its bond obligations. That was an utterly false meme. The Treasury takes in more than enough money each month to pay its bond obligations. The Secretary of the Treasury has the authority to prioritize the payment of government obligations and would have done so if necessary. To no one's surprise Congress raised the debt ceiling again (for the 79th time since 1960) so they can spend yet more money they do not have. The Republicans' cry for fiscal rectitude was pure Kabuki theater. Both parties have seen to it that they get to spend ever more money to buy votes and pay back political contributors so they can remain in office as this chart shows (red years Republican presidents, blue years Democratic). Neither party is serious about addressing what is an unsustainable situation. This ensures more crises to come.

What results from unfettered growth of the money supply? The predictable outcomes are rapidly rising food prices (left chart below) and vehicles prices (right chart).

Source: Wolfstreet

After the Fed realized that it was far behind the curve regarding price inflation it quickly raised rates. What results from higher rates? The predictable outcomes are rising mortgage rates (left chart) and falling home sales (right chart) as evidenced by crashing mortgage applications.

Source: Wolfstreet

It is helpful to visualize how the Fed is always caught flatfooted by changes in the economy. All we have to do is examine the Federal Fund Rate that it uses to try to micromanage the $23 trillion US economy from the Eccles Building in Washington DC.

Have you ever been a passenger in a car when the driver rushes up to red lights and slams on the brakes, then accelerates rapidly when it turns green and rushes up to car in front of him? You would probably consider him to be a very unskilled driver. When the Fed finds itself caught off guard by rising inflation it slams on the economy's brakes by rapidly raising interest rates which sometimes causes recessions. Then it abruptly changes its "strategy" and floods the economy with cheap money through zero-bound interest rates causing the economy to once again overheat. While the Federal Reserve Bank fancies itself to be a wise steward of the economy, the evidence plainly refutes that belief. A cynic might liken the Fed to a firefighter-arsonist who secretly lights fires so he can then rush to the scene and be a hero.

China's Growing Problems

China, the world's workshop, is not immune from fiscal problems. Ambrose-Evans Pritchard notes issues facing President Xi and the Chinese Communist Party.

Caixin magazine reported last week that the local authorities are drowning under $10 trillion of ‘hidden debt’ that they can no longer fully service. Some are having to cut medical benefits for the elderly. The orthodox (IMF) way out is to wipe the slate clean with root-and-branch restructuring of debts, which is what Japan failed to do in the 1990s, and China is now failing to do, because it is traumatic and runs into powerful vested interests. Chinese economist Cheng Xiaonong says that a pervasive fear of the future has pushed the middle class into “survival” mode. There is a spontaneous “collective action” to withdraw from property, equities, and business investment, leading them to hoard savings and repay loans as fast as they can. This is eroding the interest revenue of the banks and tipping them into a slow death spiral.

Unemployment is a growing problem. This year's eleven million college graduates will find it ever more difficult to obtain employment. When Xi Jinping secured his third term in office in 2022, unemployment in the 16-to-24 year old set was about 18%. It is now over 20% - and growing. History teaches that large numbers of unemployed youths can quickly become a threat to those in power. Xi has his hands full.

An official policy of the CCP has come back to bite in a very unexpected way. That is the infamous "One Child" edict. It was implemented in 1979 to address what was expected to be a crushing population explosion. The government ruthlessly enforced the law through propaganda, penalties and forced sterilizations. As all authoritarian regimes, Chinese elite (the CCP) cared little for basic human rights and viewed the general population as mere tools to achieve the elites' agendas. The policy had unexpected effects. It caused families to abort millions of girl babies as they favored males who could look after them as they aged. This resulted in a dramatic mis-match between the male/female population and a dramatically shrinking population of young people but increasing number of elderly. The policy was withdrawn in 2015 but the population continues in rapid decline despite recent permission to have two or three children as women have entered the work force and favor that to rearing children.

One thing China (Russia and India) have been busy doing is off-loading US Treasuries that they have held as financial reserves. When the US decided to weaponize the US dollar to sanction Russia for its invasion of the Ukraine it froze the Treasuries owned by Russia. Other countries quickly realized that they could suffer the same fate at some time in the future and need to protect themselves. The political decision to use the US dollar as a financial weapon was incredibly ill-advised and the US will rue the day it took that action. With these former buyers of Treasuries out of the picture it is increasingly likely that the Fed will be forced to buy future debt with more printed money.

Conclusion

We have been told by some readers that our letters focus on the negative and give too little voice to the positive. There is truth to that. It is our intention to bring to your attention facts that the main stream media ignore. If all one reads is news that the Dow is up 1% today and price inflation is down 0.2% that does not provide a balanced view of the state of the whole economy. We hope you find our material useful in developing your macro view of the economy.

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance. © All rights reserved 2023