Ray Dalio: We Are "Here" In the Economic Cycle

Since 1945 there have been 12 and a half credit/debt/market/economic cycles and associated political cyclical swings. We are now about halfway through the 13th short-term debt cycle. This is when the tightening to fight inflation is causing a cracking in the financial markets and just before there is the economic contraction part of the cycle. Looking at the long-term debt cycle, debt asset and debt liability levels have become unsustainably high via unsound finances, and debts are projected to increase so much that they will have to be bought by central banks (who themselves are close to having negative net worths because of the big losses they have on the debts they already bought).

Given these conditions, it appears that interest rates that are high enough (and money and credit that is tight enough) to fight inflation and provide lender-creditors with adequate real returns will be unbearably high for borrower-debtors. This means the system is close to the point where big restructurings will be needed. When these forces come together in the magnitudes that we are now seeing, history has shown that it is likely that we experience seismic shifts in financial orders, domestic orders, and world orders. For these reasons, it appears to me that we are here. [As shown on the chart above].

In other words, there is little doubt in my mind that the existing world order is changing rapidly in challenging ways and that people who are living on the assumption that things will work in the orderly ways that they have gotten used to will be shocked and hurt by these changes to come.

Is Mr. Dalio's assessment unduly pessimistic? We think not. First, three of the four largest US bank failures ever have taken place in just the last two months. Then, consider what it is that triggers almost all financial crises: massive debt that is becoming unmanageable. Large numbers of debtors finding it increasingly difficult to service their interest rate burden or they cannot find a lender who will agree to extend their debt into the future. This chart reports "All Sector [US Public and Private] Debt." The total is over $90 trillion.

The government borrows a lot of newly created money as an alternative to imposing higher visible taxes on the public. This loss of purchasing power is best described as an inflation tax, but the political class correctly believe that voters are too stupid to make this connection and will not demand an end to it. Money is not the root of all evil but a legally sanctioned monopolistic power to create money is nothing more than a legalized ring which is the root of all evil.

Ludwig von Mises noted long ago the manifest evil of government money printing,

A government’s plans concerning the determination of the quantity of money can never be impartial and fair to all members of society. . . . It always furthers the interests of some groups of people at the expense of other groups. It never serves what is called the commonweal or the public welfare.

The vast majority of new money sluiced into the US economy over the last fourteen years by Congress and the Fed has ended up in the hands of the already wealthy. It works that way because that is how the system is designed to work. The Federal Reserve System was created by bankers and the financial elite to serve the interests of bankers and the financial elite. We urge you to read The Creature from Jekyll Island by G. Edward Griffin. It describes the scheming by the wealthy elite to create the central bank.

Who gets bailed out when bank debts blow up and banks fail? It is always bankers and the rich. Witness the recent bailouts where banks and account holders with millions of dollars over the $250,000 deposit guaranty limit were bailed out. Silicon Valley Bank held billions of dollars in reserve in the form of US Treasury notes that it had purchased when interest rates were next to nothing. When the Fed was forced to raise rates to stem inflation, those notes lost value because no one wants to buy a note paying .25% interest when new notes are paying 5% interest. To meet withdrawal demands, SVB was forced to sell its notes at a loss of over $1.8 billion.

Other banks found themselves in the same situation and their stock prices also cratered. First Republic Bank lost 94% of its value in very short order (almost 50% on April 25th). Its share price of $222 in late 2021 fell to $3.51 as of April 30th. FRB was just sold to JP Morgan Bank. Zerohedge reports,

And so JPM, which is already the largest US bank is about to get even bigger by scooping up all the good FRB assets while leaving US taxpayers holding on to the toxic ones.

It appears that JPM will acquire the majority of FRB's assets including $173 billion in loans and $30 billion in securities as well as $92 billion in deposits. The FDIC estimates its insurance fund will take a $13 billion loss and it reached an undisclosed "loss-sharing" agreement with JPM on FRB's loans.

The magnitude of the banking problem is difficult to grasp. The thirty largest US banks hold over $7 trillion in deposits that are over the $250,000 FDIC insured limit and their reserves are largely US government bonds whose value has fallen markedly. Wall Street On Parade describes the sorry state of American banking (with links to its earlier reports),

Both Silicon Valley Bank and First Republic Bank are California-headquartered regional banks. The contagion from Silicon Valley Bank had directly impacted First Republic Bank. By the date of that Senate Banking hearing on March 28, First Republic’s common stock had lost 90 percent of its market value – just in the month of March.

It might be possible to come back from that if one is a start-up tech firm, or an acknowledged high-risk innovator. But Americans put their money in federally-insured banks because they want safety; because they want the peace of mind of knowing their deposits will be protected despite what happens in the Wall Street casino on any given day. In that vein, Jamie Dimon was the worst possible choice to head up a rescue of First Republic Bank as he is the personification of what happens when a trading casino is allowed to own the largest federally-insured bank in America. Under Dimon’s tenure at the helm of JPMorgan Chase, it has been charged with losing $6.2 billion of depositors’ money by gambling in derivatives in London; its precious metals traders have been charged under RICO – the statute used to prosecute the mob; it has received an unprecedented five felony counts from the U.S. Department of Justice, including aiding and abetting the largest Ponzi scheme in history by Bernie Madoff, and on and on.

S&P Global has already downgraded First Republic Bank into junk territory; excluding the $30 billion in strong-armed deposits from the mega banks [JP Morgan et al], First Republic lost a staggering 58 percent of its deposits in the first quarter of this year; and its wealth advisors are leaving and taking billions of dollars in clients assets with them to new firms. Since when did it become a rational move for one federally-insured bank [JP Morgan] to link its brand and reputation to an imploding bank?

How is the Federal Reserve Bank managing the inflation crisis? Recall that it loudly and proudly declared that it was reducing its balance sheet that grew to Brobdingnagian size during the the 2008 financial crisis and Covid shutdowns. Unfortunately, the recent banking crisis made it fall off the wagon once again. It was forced to implement what it blandly calls its Bank Term Funding Program wherein it buys at face value government bonds that are deeply underwater due to rising interest rates. This program has again juiced its balance sheet. Weiss Ratings provides the visual.

One could readily - and mistakenly - conclude that the money supply has thankfully returned to its former level and that inflation will soon be eliminated from the economy. This could not be farther from the truth. If the money supply increases an average of 10% every year for ten years, it will more than double in size due to the compounding effect. If the rate of growth then goes negative 5% for a year as shown above, we are not back to where we started as the chart suggests. Rather, the money supply remains more than double its original size and continues to feed inflation.

This chart shows US consumer spending. In that real wage income is falling, much of this spending is financed using credit cards (over $1 trillion) that bear >20% interest rates. Equally worrisome is that overall household debt now exceeds $17 trillion. This suggests that the banking system that financed this spending remains at elevated risk.

The US Office of Financial Research issues what it calls its "Contagion Index." It ranks the banks that it says present the greatest amount of risk to the system. The OFR explains its Index as follows,

It measures the loss that could spill over to the rest of the system if given a bank were to default. It depends on the size of the bank, its leverage, and how connected it is to the other financial institutions:

OFR Contagion Index = Connectivity X Net Worth X (Outside Leverage).

Connectivity is defined as “the share of the bank’s unsecured liabilities that are held by other financial institutions. It is the ratio of the bank’s liabilities within the financial system to the bank’s total liabilities. With higher connectivity, a bank’s failure has a potentially broader impact on the rest of the financial system.”

A bank’s net worth is “the difference between a bank’s assets and its liabilities. A larger bank’s failure can have a broader impact on the financial system, other things being equal.”

Outside leverage is defined as “the vulnerability of the bank to shocks from the real side of the economy. It is the ratio of a bank’s claims on non-financial entities to its net worth.”

A picture is worth more than all of the above words. Here is the OFR's risk ranking of banks as of 2022 year end - before the most recent crisis developed.Contrary to the misleading reporting in the mainstream business press, it wasn’t the regional banks that were losing the bulk of deposits in the U.S., with the biggest banks the beneficiaries, it was actually the biggest banks that were dramatically shedding deposits. We explained as follows:

“The reality is that the 25 largest domestically-chartered commercial banks in the U.S. have been bleeding deposits for most of the past 12 months, shedding more than $700 billion in deposits between April 13, 2022 and March 29, 2023. To put that in even sharper focus, all U.S. domestically-chartered commercial banks have lost a total of $970 billion during the same time period. That means that the largest 25 banks account for a whopping 72 percent of the plunge in deposits over the past year.”

On Friday, we learned more granular details about this deposit exodus when JPMorgan Chase and Citigroup announced first quarter earnings and released data on their deposits. According to its own figures, JPMorgan Chase experienced an outflow of $183.95 billion in deposits between March 31, 2022 and March 31, 2023.

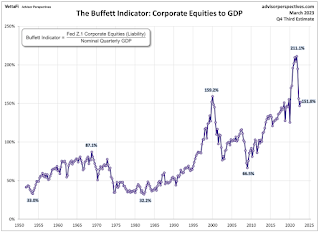

The question close to the heart of all investors is what does all of this mean for the markets' expected returns in the future? Is now the time to get back in the market? Here is a chart of the widely followed "Buffett Indicator" that charts stock prices against US GDP. Historically, when the indicator is high, future returns tend to be low. When it is low, future returns tend to be higher. It is down from its recent high reading of 211 - but at 151 it remains near its 2000 "dot-com" bubble high, well above historic "buy" levels. Thus, buyer beware.

A Final Thought

Ray Dalio recently issued a new post. It discusses the rapidly deteriorating relationship between the US and China and possible dire consequences. If you value your sleep, do not read it before going to bed. Nevertheless, it is a very important topic that is receiving precious little attention in the main stream media. Copy and past the link in your browser:

https://www.linkedin.com/pulse/what-i-think-going-1-china-us-relations-2-other-countries-ray-dalio

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance. © All rights reserved 2023