Having Your Pocket Picked - Daily

"There is no art which a government learns sooner than that of draining money from the pockets of the people."

- Adam Smith 1723-1790

And there are those eager to facilitate that draining. Martin Wolf writes a column for the Financial Times newspaper. He is highly regarded - by those in government and academia. Larry Summers calls him "the world's preeminent financial journalist." Mohamed A. El-Erian says he is "by far the most influential economist out there." Kenneth Rogoff calls him the "premier financial and economics writer in the world." Wolf recently penned an FT editorial, "The case for a land value tax is overwhelming." He wrote,

I have long been a supporter of taxing land value. Such a tax would be economically efficient and morally just.... The land under my house has, for example, increased enormously in value over the past few decades. I did nothing to earn this. It was the result of the efforts of all those who contributed to making London richer, including of course, the public at large, through their taxes.

He proposes that this "increase in value" be confiscated (taxed away) by the government. It is true that his property's value may have been enhanced, for example, by the installation of new street lighting. What he ignores is that he and his fellow taxpayers paid for that new lighting. If they paid for the improvement, where is the "morality" in confiscating its value? The same would be true if the government taxed away the increase in value of his property after he installed air conditioning, a heat pump or solar panels. Those increases in value were not "windfalls" to him. He paid for them.

But there is a far bigger issue that Wolf ignores. The vast majority of the purported "increase in value" of his property is the result of price inflation caused by the debasement of his currency by his (elected) representatives and (unelected) central bank governors. The "real" value of his property (net of inflation) may not have increased much at all. And Wolf further ignores the fact that he has paid an "inflation tax" on all the goods and services he has purchased over the decades - thereby paying for the increase in his property's assessed value. To tax the increase of devalued pounds sterling, would be to confiscate his property in continuing slices. Thus, Wolf's proposal is not "morally just" but reprehensible. How he has managed to live in the world of economics for so many decades and yet be so oblivious to the impact of inflation on the nominal prices of property, goods and services is a mystery. It makes clear why we do not want to be lorded over by "experts."

It was recently reported that US consumer prices rose, year over year, another 6.4% through January. Which is another way of saying that the US dollar was devalued by another 6.4%. Did that add "value" to your home? Recall Warren Buffet's admonition that "price is what you pay, value is what you get," meaning nominal "price" is often unrelated to "value."

Governments' endless devaluations of our currencies is insidious. If the inflation rate is 6.4% and you sell a stock that increased in price by that amount, you have made no "real" profit. You are in the same financial position you were formerly in. However, you will pay tax on the 6.4%% increase being left worse off than you were when you started. Our government's failure to index tax rates to take into account price inflation - that it created - is theft and immoral. While the wealthy are not as seriously harmed by inflation as the poor (because they invest in assets that tend to rise during inflation), it is eating the working classes alive. Their wages may have risen 5% last year but with inflation rising at 6.4% (or more realistically over 10%), they get poorer every year. History shows that continuous financial abuse of the working classes by the elite leads to unpleasant outcomes (think: the French Revolution).

The Energy Crisis

Another way our governments are setting us up for great pain is their rush to eliminate energy produced by nuclear, oil and gas. The UK Telegraph's Ambrose Evans-Pritchard addresses this problem.

Three quarters of British homes are heated exclusively by gas. The fleet of 1.5 billion vehicles on the roads today will depend on petrol and diesel for a long time. Ditto for aviation and maritime fleets.

Old fields are depleting. Few new projects are coming on stream. Shale drillers have tapped the best seams in the Permian. The “expected ultimate recovery” of wells has dropped this year for the first time since the fracking boom began.Investment in nuclear, renewables, and electrification has not compensated. It needs to rise by a factor 2.4 this decade to plug the gap.“The world is underinvesting in all forms of energy,” said Columbia University’s Jason Bordoff. The danger of a botched transition should by now be obvious, and so should the danger of a premature and misplaced campaign to disinvest from well-run western oil majors, which have much lower methane emissions than the bad actors, and which bolster the energy security of our democracies.

Most people agree that eliminating polluting sources of energy is a desirable goal. But draconian edicts do not produce energy and the modern world is dependent on cheap, abundant and reliable electric and fossil fuel energy. As Evans-Pritchard notes, the trucks, trains and planes that deliver people and goods around the world depend on fossil fuels. The farmers that produce our food depend on fossil fuels. Getting from here (dirty energy) to there (clean energy) is a monumental task. What is of no help is to be lectured by the hypocritical elite who fly in their private jets to Davos each year for the World Economic Forum where they hector us to live more constrained lifestyles (become vegetarians, turn down our heat, ride bikes to work). They will not be giving up their jets, they will continue to eat beef and caviar and drink fine wine, they will not be uncomfortable in their homes during the summer or winter and they will not be eating the "insect protein" they have in mind for the rest of us. Joel Bowman pins the tail on Davos' "big thinkers,"

In the rarefied air of smug and hubris, the planet's moral exemplars gather to look down their long noses at the failing peasants of the flatlands, mired as we are in the fifth and disgrace of our own ignorance. There they plan and plot our future, deciding everything from what we will own (nothing) to how we’ll feel about it (grateful), from where we will live (in special “zones”) to how we will travel (barely at all and only with their permission), to how we will transact with our fellow chattel (via their Central Bank Digital Currencies) and of course, what temperature the planet should be half a century from now... and the sacrifices we peasants need to make in the meantime.

The WEF is not shy about its goals and who is in charge of achieving those goals (they are). It proudly asserts in its mission statement that it “engages political, business & other leaders of society to shape global, regional & industry agendas." F.A. Hayek warned in his acceptance speech for the 1974 Nobel Prize in economics that,

The most dangerous person on earth is the arrogant intellectual who lacks the humility necessary to see that society needs no masters and cannot be planned from the top down. An intellectual lacking humility can become a tyrant – and an accomplice in the destruction of civilization itself.

Globalists' pressure to close our reliable base-load nuclear, oil and gas energy generation plants before replacement sources of energy are on-line assures that we will all suffer California's ongoing nightmare of excessively high energy costs, routine brown outs, periodic calls for extraordinary limits on energy use (state-ordered factory closings) and outright energy supply failures. Ill-conceived policies by "big thinkers" always lead to disaster.

Future Breaking "News:"

President Biden: "My fellow Americans, I have today signed an Emergency Executive Order immediately closing all food stores. I have taken this action because they consume vast quantities of energy for lighting, refrigeration and the transportation of goods. I have directed the Secretary of Agriculture to forward seed packets to all Americans so you can grow your own food and become independent of the profit-gouging food cartels."

Reporter: "But....but...Mr. President, it will take months for those vegetables to be ready for harvest. What are the people to eat in the meantime?"

President Biden: "Don't be a climate denier!"

The Fed's Fight Against Inflation

After printing trillions of dollars and forcing interest rates to negative real terms that goosed US inflation to forty-year highs, the Fed was reluctantly forced to raise the Federal Fund rate to 4.5%. We are told that overall inflation is 6.4%. So-called "core" inflation (which omits the price of the food and energy we must consume every day) is reported to be 5.6%. However, real inflation remains at much higher levels. Even according to the government's sawed-off calculations, "services" prices are up 7.6%, food away from home up 8.2%, energy up 8.7%, and food at home is up 11.3%. Services inflation is up because labor costs continue to rise as workers demand salary increases to off-set the Fed-created price inflation. This shows no sign of abating, suggesting a 1970's style "wage-price" inflationary spiral may be baked into the cake.

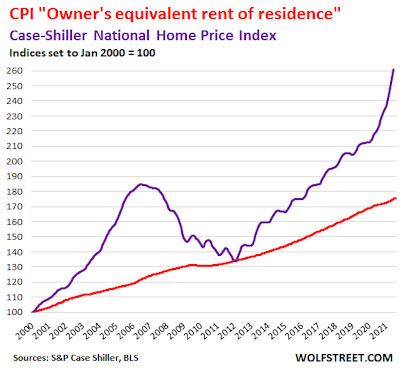

Housing costs remain high - much higher than the Fed's fanciful "owner's equivalent rent" calculation. This chart shows the huge disparity between the OER (red line below) and housing prices captured by the Case-Shiller index (purple line below) that is based on actual sales price increases of the same homes. Housing makes up about one-third of CPI. Thus, when the government falsifies the cost of housing it materially (and intentionally) understates the real rate of inflation. Using actual housing costs, "core CPI" is closer to 8%. If the CPI were calculated the way it was formerly done, it is a much stiffer 13%.

The $64,000 question is whether the Fed's rate increases to date will be enough to reduce price inflation to its (arbitrary) 2% goal. That will be a challenge. According to the Congressional Budget Office, the national debt is scheduled to rise by another $19 trillion in the next ten years taking it from today's $31 trillion to $50 trillion. That calculation is premised on the dubious assumption that there will be no additional programs needing new funding, there will be no recessions with reduced tax receipts and that programs set to "sunset" will actually end as scheduled. Therefore, we expect the $50 trillion in national debt to be achieved far sooner. In his State of the Union address, President Biden identified a litany of new programs he wants the taxpayers to fund.

What might constrain this new spending? One factor is the rapidly rising cost of servicing the existing national debt. The Treasury Department paid $213 billion in interest payments in the 4th quarter of 2022 on its outstanding bonds. That is $852 billion annualized, close to what we spend on national defense.

The Treasury's Q4 interest expense was up $63 billion from the same period the year before and up $30 billion from Q3. Combine this rapidly escalating expense with Social Security and Medicare costs and you have a developing nightmare. These two social welfare programs alone will cost $2.3 trillion in the coming year and some $31.5 trillion over the next ten years (as much as our current total national debt).

These programs are supposed to be funded by paycheck withholdings. See if you can spot the problem: Social Security will pay $543,000 in benefits to low lifetime earners but receive only $189,000 in withholding payments. For married couples with one earner at the average wage, benefits will total $1.157 million but it will receive just $420,000 in withholdings. A single male earner will receive $606,000 in benefits versus just $420,000 in withholdings. Current benefits are barely being covered by withholdings taken from existing workers. As the labor force participation rate continues to shrink and the number of retirees grows, the programs will implode.

Ryan McMaken clears up some common misconceptions,

Social Security is not an insurance program. A Social Security "account" bears no legal resemblance whatsoever to a bank checking or saving account. Social Security bestows no contractual rights or any other type of property right on workers.

In other words, Social Security as it is currently structured has nothing to do with legally enforceable promises or guarantees. There is no "trust fund" as that term is commonly understood, no funded segregated accounts, no IOUs or bonds stored in some lockbox, or anywhere else for that matter.

In Fleming v. Nestor, 363 U.S. 603 (1960), the U.S. Supreme Court set the record straight. Social Security is actually nothing more than an umbrella term for two schemes that are legally unrelated: a taxation scheme and a welfare scheme.

Workers and their families have no legal claim, grounded in the Fifth Amendment or elsewhere, on the FICA tax payments that they make into the U.S. Treasury, or that are made on their behalf. Those funds are gone, commingled with the general assets of the U.S. government and fully available for purposes unrelated to Social Security. Being mere welfare recipients—not creditors or holders of equitable property rights—workers have hopes or expectations of future benefits, but no enforceable rights to them.

Nestor stood on the shoulders of a previous case, Helvering v. Davis, 301 U.S. 619 (1937). In Davis, the Court had confirmed that Social Security is not an insurance program. During the Helvering oral arguments, the Chief Justice had anticipated Nestor when he speculated from the bench that Congress would have the authority to abolish the welfare component while keeping the taxation component in place.

What would Congress have to do to balance the federal budget to allow the continuation of benefits? One option is cutting all federal programs by 26%, a second is to exclude cuts for "essential" programs such as defense and veterans' benefits, a third is to also exclude Social Security, and a fourth is to also exclude Medicare which would require cutting all other programs by 85%. You can see below the size of cuts necessary for each choice. None of this will happen because our elected officials will refuse to offend the large voting blocks in each category for fear of being voted out of office and having to make an honest living. The same is true in all countries.

How Might I Do That?

Identifying the problems confronting our economies is the easy part. But then what? First, accept the fact that it makes no difference which political party is in office. These problems have metastasized for fifty years under the "leadership" of both major parties. Second, accept the fact that your government will continue to devalue your currency as has every government that has gone before - every single one. Exhibit A: the mighty Roman Empire. In 15 B.C.E. Caesar Augustus decreed that the denarius coin was to contain 95-98% pure silver at a fixed weight of 4.5 gr. (It was valued at ten asses.... another coin, not the animal.) It was then continuously debased by subsequent emperors over the next 270 years both in weight and purity until it contained just 2% silver. It took its final form as a bronze coin.

Older US readers will recall that their dimes, quarters, half dollars and silver dollars were 90% silver. As paper dollars were printed in excess (i.e., devalued) to pay for Lyndon Johnson's "Great Society" and not-so-great Viet Nam war, those coins soon had greater silver value than face value and were being hoarded. (Gresham's Law at work - bad money drives good money out of circulation.) In 1965, Congress passed the Coinage Act. It eliminated silver from dimes and quarters and reduced the silver content of half dollar from 90% to 40%. Silver was totally eliminated from the half dollar just two years later. Even the lowly US copper penny had to be replaced with a zinc coin and copper wash when it started costing more than a penny to make one. The same has undoubtedly happened to your coinage over time. Today, even a zinc penny has some intrinsic value. Paper money has no intrinsic value whatsoever. Thus, storing wealth in your or anyone else's currency is foolish. What are your options?

Throughout recorded history, the rich have stored their wealth in three principal assets: land, art and gold. These remain excellent choices. But each has its pros and cons. Land has always been equated with wealth because it produces rents, grains, meats, grapes, olives, apples, timber and many other things of value. On the downside, if you farm your own land, you have machinery to buy and repair, workers to hire, animals to care for, and seed and fertilizer to buy. All can be in short supply or at great expense when you need them most. If you rent your land to others there are different problems. We discovered during Covid that governments can forbid you from evicting tenants who fail to pay their rent. That did not relieve you from having to pay your accruing taxes, insurance and maintenance costs. A big negative for real estate is that if you must flee due to war, plague, pestilence, civil unrest or otherwise, you cannot take it with you. If you need to raise cash quickly for an emergency you might find it impossible to sell your land at a fair price or borrow against it at a fair interest rate. Furthermore, your government can raise land taxes or limit the purposes to which you can put it making its ownership no longer worth while. And, of course, land can be summarily confiscated should you fall out of favor with those in power. That has happened throughout history.

Art is another time-tested store of wealth. But it too is a tricky asset. Tastes in art continually change. What is popular today may fall out of favor in the future dramatically affecting its value. It will always be of value to you if you enjoy it but its sales value may be seriously diminished. Old Masters' paintings and sculptures have remained in high demand for centuries but there is no guarantee that will always be the case. Selling a painting or sculpture for a fair price on short notice can be a problem and depending on its size or weight, transporting it quickly might be difficult or impossible. If you are slow to recognize developing dangers, art can be confiscated as was done during World War II.

Another asset that has stood the test of time is Gold. It has been a form of money for more than 5000 years. It is both liquid and reasonably transportable. One fraught issue is where to store it. If you do so at home it is subject to theft. If you store it in a bank it is subject to future confiscation (a la' Franklin Roosevelt). Be aware that those in political power always denigrate gold and discourage its ownership because if you own gold that prevents them from stealing your wealth through fiat currency inflation. That alone is a strong inducement to investigate its purchase.

Former Fed chairman Ben Bernanke publicly derided gold as an anachronism (a "barbarous relic") that has no role to play in the modern world. When asked by an astute reporter, "Why then does the US Treasury retain 8000 tons of it?" he nervously cleared his throat, coughed quietly into his hand and then lamely suggested that gold was kept out of "tradition." That, of course, was a palpable lie. Central banks keep gold to lend credence to their nation's circulating fiat paper currency that has no intrinsic value. These same people derisively refer to those who buy gold as a "gold bugs" suggesting they are nutcases. If you bought gold when it was $35 per oz, or $100 per oz, or $1000 per oz and they did not, who is the nutcase?

The major media assiduously ignores the news that central banks have been big buyers of gold. Did they spend billions to acquire a pretty but useless anachronism? The World Gold Council announced that in Q3 2022 central banks bought 399 metric tonnes of it, a 150% increase from a year ago, and 1136 tonnes throughout the year. Who are they and why are they buying gold? They include Russia, China, and India. The US locked Russia out of the international dollar payment system (SWIFT) following its invasion of Ukraine. This made it difficult for Russia to buy and sell goods from other countries using dollars. The US thereby "weaponized" the dollar which had been acting as the world's reserve currency.

China quickly recognized that it is just one invasion of Taiwan away from being in the same boat. Nations that are antagonistic to the US - and ones that may become so - are planning alternative, non-dollar payment systems. One backed by gold would be readily accepted world-wide and could eventually displace the dollar as the world's reserve currency. Russia recently increased the ceiling for gold held in its sovereign wealth fund from 20% to 40%. China, the world's biggest gold producer, which typically keeps its gold holdings secret, announced that it added 30 tonnes in December 2022 and another 32 tonnes in November.

Gold is held throughout the world. It is estimated that there are more than 9000 tones of it in private vaults within London's M25 highway loop. Consider: Does a nation become richer by printing more paper money or by accumulating gold? We put the same question to you. Long-term, are you better off with a stash of constantly devaluing dollars/euros/etc. or with gold? Of course, it would be a serious mistake to go "all in" with any asset class. But one would have to be blissfully ignorant about the perilous state of all governments' finances to feel secure holding large amounts of currencies.

The advantage of gold is that it is one of the few asset classes that is not also someone else's liability (as are all bonds) and is not dependent on someone else's performance (as are all stocks). It is the only true international currency because it is not controlled by any government and cannot be "printed" into existence. While its price can rise or fall based on usual supply and demand factors, it has risen against the dollar from $35 per oz. to nearly $1900 per oz. - which is the flip side of saying that the dollar has been devalued 99.2% against gold. Do not make the mistake of thinking that the dollar can only fall another 0.8% against gold. It can fall another 99.2% given our political overlords' history of trying to gain or remain in office by buying our votes with devalued currency.

There are several ways to gain exposure to gold. The most obvious is to buy gold coins and bars. Coins come in both numismatic (rare coin) form and in "bullion" coins like the US and Canadian Mint's one-oz. gold coins. A downside to numismatic coins is that their value over the price of their gold content is not apparent to anyone but collectors. Coins and bars can be readily purchased from coin dealers. Be aware that you will pay a mark-up over the bullion price of the metal. That mark-up can at times of high demand be excessive. (A website to compare prices is findbullionprices.com.)

Another way to gain exposure to gold is to buy gold mining stocks. However, miners face the same issues that all producers do: including labor costs and strife, government taxation, harassment and confiscation, weather, energy costs, equipment costs, maintenance, etc. One advantage of miners is that if the price of gold soars, their gold reserves in the ground soar in value. Look for miners with low costs of production in politically favorable locations. There are also futures contracts and options tied to gold. Understand that these are not gold but devices to bet on its price. It is our view that "a bird in the hand is worth two in the bush." "In the hand" does not necessarily mean keeping gold in your personal possession. One might consider keeping some in a location outside the direct control of your government.

Still vacillating about the place for gold in your portfolio? Consider the advice of legendary banking tycoon J.P. Morgan who resolutely declared,

"Money is gold. Everything else is credit."

There are, of course, other items that can store wealth in a form not subject to inflation, including other precious metals and stones. The latter's biggest advantage is that you can store very large value in a very small package. That makes them ideal for an unplanned departure. One of their bigger drawbacks is that, unlike gold coins, each stone is unique and its value not readily obvious to the vast majority of people. Their high value also makes them useless for the purchase of common necessities. Another drawback is that you must become expert in valuing them prior to purchase to avoid being taken advantage of by unscrupulous sellers. Finally, some gems can now be created in factories, including near flawless diamonds. You would be hard-pressed to tell the difference. This may adversely affect the value of all diamonds over time.

Conclusion

Consider taking prompt action to protect yourself and your family from your government's continued debasement of your currency. Failing to do so ensures that your wealth will be confiscated through monetary inflation.

Should you like to have future issues delivered directly to your email, feel free to enter your email address in the location indicated at the top left of the page. We will never share your email address with anyone.

Important Message: The foregoing is drawn from information believed to be true but its accuracy is not guaranteed. Nothing contained herein is a personal recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy and assets that meet your unique circumstances, investment objectives and risk tolerance. © All rights reserved 2022