"WHAT'S PAST IS PROLOGUE"

So said Antonio in Shakespeare's The Tempest, to his co-conspirator Sebastian, to justify the murderous act they were about to commit. Today the phrase is used less ominously to mean that history sets the stage for what happens next. About that there can be little doubt. The present is necessarily built on the foundations of what has come before. This leads us to believe that our future will be an extension of the present. In the world of psychology, this is known as "recency bias." However, the future often plays out very differently than expected because we have misinterpreted what has actually happened and ignored obvious risks.

Recent examples of unexpected futures were governments shutting down the world's economies for more than two years in response to a virus and flooding the world with liquidity for fourteen years (2008-2022). Both actions were deemed essential by politicians and "government experts" and were opposed by numerous independent experts. Both events had severe consequences which were readily foreseeable but ignored at the time. We cannot "rerun" history to test alternative government actions, but with regard to Covid we have the benefit of Sweden's response: no shut down of its economy or education system, with a far better outcome. Government officials and their media flacks never revisit these decisions because doing so will require abject apologies and result in lost elections. In the realm of politics the rule is: "Never reflect, never apologize."

What Surprises Might 2023 Have In Store?

At the start of each new year many people feel compelled to predict what will come next, particularly in the realm of politics and the economy. Most of these predictions (guesses) widely miss the mark. Dan Ferris counsels: "Don't predict. Prepare." His thesis is that no-one can reliably predict the future and if you are wrong-footed by your efforts at doing so you will pay a heavy price. With that in mind let us review last year.

The last twelve months were very painful for most investors. Stocks tanked, bonds tanked, and many other asset classes suffered with them. The NASDAQ was down almost 33%, US Treasuries (20+ yr.) were down 31%, tech was down 30%, the Russell 2000 was down 20%, the S&P was down 18% and the Dow Jones was down 7%. Foreign markets took it on the chin as well (MSCI World Growth -29%) with the FTSE 100 being the surprise exception (+5%). It seemed as if there was nowhere to hide. But that was wrong. There were several bright spots: commodities were up 24% and energy was up nearly 59%.

In addition to the markets taking hits, Russia's brutal war on Ukraine continued, European energy supplies from Russia were shut off causing gas prices to soar, and supply chains fought to come back to life following two years of government mandated Covid shut-downs. Mid-term elections in the US resulted in a split Congress foretelling much conflict to come. Many people consider that a big win as neither party will be able to push through more ill-considered, debt increasing legislation.

Investors fervently hope that the Fed's rate increases will quickly bring down price inflation to a level that will allow it to lower rates and then add new liquidity so the glory days of soaring stock markets will return. Jay Powell has repeatedly said that rates will continue to rise in 2023 and that he will not "pivot" to monetary ease until price inflation falls to his 2% goal. We admire his rhetoric but are not persuaded that he will follow through. We suspect that if there is a big "credit event" (large corporate or bank failure) he will wilt like a flower on a hot day and flood the economy with more "stimulus" (cheap money). That is because his biggest concern is not that inflation stays elevated and continues to impoverish the working classes, but that equity markets crash impoverishing the elite who own the vast majority of the stocks.

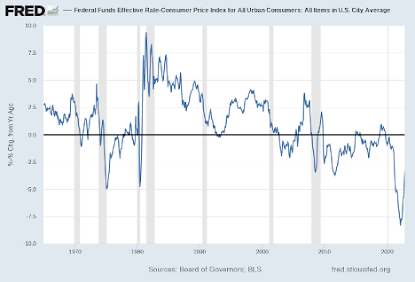

Despite the fact that the Fed has raised rates substantially, "real" interest rates (net of inflation) are still in negative territory. Thus, the Fed is still being monetarily "accommodative." Historically, real rates have been in the positive 2% range. They have a long way to go to get back to that level.

We have previously noted that government supplied inflation statistics are a joke. Shadow Government Statistics tracks the rate of price inflation the way the government did until 1980 when inflation became so high that the government needed a way to keep that bad news from the voters. So it started making "adjustments" to the way inflation was calculated which always results in a lower reported rate. Calculated the way it was previously done, price inflation today is near 15%. Thus, real Fed fund rates are over 10% negative. Real negative rates are what drove price inflation to forty-year highs last year. The Fed grew the money supply (monetary inflation) much faster than the growth of goods and services resulting in rising prices (price inflation). It is very slowly reducing its obscenely bloated balance sheet of government bonds and mortgage backed securities that it bought with newly printed money. Chairman Powell hopes to overcome decades of Congressional and Fed fiscal and monetary profligacy without causing anyone any pain.

The honest way to overcome an economic contraction is to recognize and liquidate past mistakes so that the healthy portion of the economy can grow, unencumbered by the ongoing costs of supporting failing businesses. It is estimated that 20% of the Russell 5000 companies are "zombies" - meaning they do not make enough money to pay the interest on their loans much less ever repay them. That is one out of five or 1000 companies! If the banking system continues to supply financing to them, that financing is not available for the healthy businesses that are the best hope for the future. Banks are not eager to write off those bad loans as they will then have less reserves, less money to lend, lower net interest income and most importantly, smaller bonuses for bank executives. Not doing so ensures a future banking crisis with the Fed called upon to ride to their rescue once again - with you, the taxpayer, footing the bill.

The self-correcting nature of capitalism solves the problems of mal-investment and incompetent management. Failing companies close their doors. This allows the nation's limited resources (financial, raw materials and labor) to realign with the stronger, better managed companies. This process is what economist Joseph Schumpeter called "creative destruction." The fit and successful businesses survive and the weak and incompetently managed ones fail. This strengthens the economy for the long-term betterment of all. When the government or central bank intercedes to support failing, politically-favored businesses, the economy necessarily suffers to the detriment of all.

As the Fed became more active in trying to "manage" the US economy (a preposterous notion), that economy has predictably gotten weaker. The US had an annual GDP growth rate of over 3% in the 1960's. In the 1990's it was over 2%. Today it is less than 1%. It is noteworthy that prior to the sub-prime crisis in 2008 with its massive government interventions, the US had less than $10 trillion in public debt amounting to 63% of GDP. Today that debt exceeds $31 trillion, amounts to 120% of GDP and is expected to rise to $45 trillion in ten years. Our bet? It will not take that long. The pressing question that should be front and center on the minds of our elected officials is: What is the plan to address this staggering debt? Sadly, the answer is: There is no plan. No politician has any genuine interest in seriously addressing the debt. Thus, the US bumps up against its debt ceiling once again. What will happen? After much bluff and bluster, it will be raised again at the last moment. It has been raised over seventy times since 1940 and twenty times since 2001. Why? Because both political parties want to spend ever more money. Their only dispute is on what to spend it.

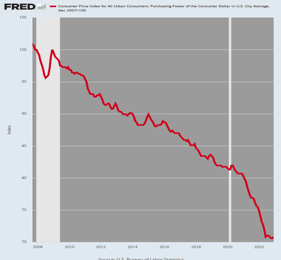

The Fed believes that it can manage every economic downturn by adding more "stimulus" to the economy - i.e., printing money and lowering interest rates. That flood of cheap money is what directly caused today's price inflation. It is self-evident that the solution to the problems caused by excessive money printing is to stop printing more of it. Since the creation of the Fed, the dollar has lost 97% of its purchasing power. This more than one-hundred year trend is something you ignore at your own risk. It will continue until the financial house of cards collapses. It will continue because there is zero political appetite to reverse it (return to a sound dollar). Of course, the dollar is not alone in this debacle. Compared to the price of gold (historic money), every fiat currency has failed to maintain its purchasing power. The yen has lost 99.98% of its purchasing power. (Note: this is a logarithmic scale. If represented arithmetically, all three currencies would look like a waterfall drop to near zero.)

Source: Weiss Ratings, Resource Trader

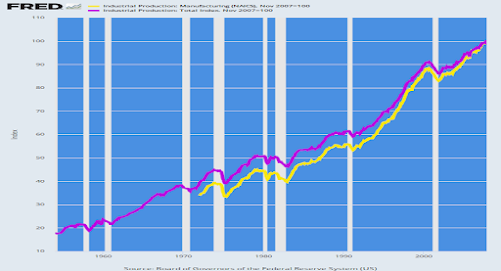

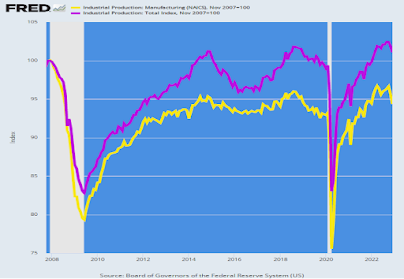

Data is useful because it helps us visualize the negative consequences when the government tries to "manage" a giant, infinitely complex, modern economy. The chart below shows the index of total US industrial production and manufacturing from 1954 to 2007. Note the steady growth of both over time despite small set-backs during recessions that are indicated by the gray bars.

Britain As An Object Lesson

The glue that has been holding the eurozone together is the world of zero real interest rates. So long as they stayed at zero [the ECB] could use QE as a transfer subsidy from the North to the South, and it didn't seem to cost anything. The underlying problem was never resolved. The one-size-fits-all rate is patently stupid - a rate that is suitable for Germany is not good for Italy - one suffers needlessly.

The risk is that German taxpayers will once again haul their government before the German Constitutional Court seeking an order on the German government to cease supplying money to the EU for these increasingly obvious transfer payments to Italy.

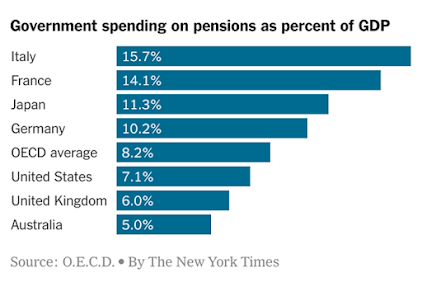

France too has huge fiscal problems. It is racked by fierce opposition to the proposed increase in the state pension retirement age from sixty-two to sixty-four. As with the US's Social Security System, when the retirement age was originally set, the average life span was in the high sixties. That meant that the retirement system only had to take in enough money from each future beneficiary to support him or her for some six years. Today the average life span in France is about seventy-six meaning that monies collected to date are woefully inadequate to pay the promised benefits.

There are several solutions. The first is the one proposed by Macron: raise the retirement age. His suggested two-year increase was undoubtedly chosen to reduce worker push-back but it is clearly inadequate to solve the problem. The second solution is to significantly raise the workers' contribution rates. The third is to reduce benefits to match the available funds. The workers can strike and march all they want but these, individually or in combination, are the only honest solutions. That leaves the dishonest (politically preferable) solution of printing money to pay the benefits. Of course, that will inevitably generate price inflation effectively reducing the benefits. Politicians hope workers will not figure that out.

All western nations are confronted with the same problem: underfunded pension promises that will continue to consume an ever-growing part of each nation's GDP.

China's Recovery

When Xi Jinping imposed his zero-covid, full lockdown on the nation, he assumed the virus would quickly abate. He was wrong. After enforcing draconian lockdowns for nearly three years (sometimes welding the doors of apartment complexes shut so tenants could not leave) he abruptly reversed course. Did he do so because he finally admitted the stupidity of the policy? Not likely. Did he do so because he feared an insurrection by 1.4 billion Chinese following unexpected mass marches and calls for his removal? Perhaps. Clearly, a motivating reason was the rapid decline in GDP growth - undoubtedly far greater that official Chinese statistics report. The slowing economy, rising unemployment and collapsing real estate market could have triggered a call for regime change. Will his sudden reopening of the economy trigger a massive Covid outbreak, a high death toll and re-shutting of the economy? Stay tuned.

China has another very serious problem: rapid population decline. The government-imposed one-child policy that forced tens of millions of women to have abortions and sterilizations had its intended effect, fewer births. What was not anticipated was parental preference for boys who could support their aging parents. Female fetuses were aborted en mass. The result is a shortage of women for marriage and a disinclination of working women to have children. As they say: be very careful what you ask for. The result is a steadily declining population of young workers who are necessary to support the increasingly large elderly population. Here are two charts depicting the problem. The first shows Chinese and Indian population growth by age group. The second shows a comparison of the two populations into the future. India is expected to take over as the most populous nation this year. We note that Japan's population has been in decline since 2008.

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance. © All rights reserved 2023