THE RIDE THAT NEVER ENDS

Source: Shutterstock

Ray Dalio, CEO and former co-chief investment officer at hedge fund Bridgewater Associates, has spent decades researching and writing about the political and financial cycles that have recurred throughout history. His book "The Changing World Order: Why Nations Succeed and Fail" is not just for historians. It is essential reading for investors. He finds that the rise and fall of major powers follow a predictable template. Armed with this knowledge, we can plot where we are in the current cycle.

He describes these repeating cycles as follows:

Throughout time and in all countries [the elite] are the people who own the means of wealth production. In order to maintain or increase their wealth, they work with the people who have the political power, who are in a symbiotic relationship with them, to set and enforce the rules [laws]. This has happened similarly across countries and across time. This dynamic leads to a very small percent of the population gaining and controlling an exceptionally large percent of the total wealth and power, then becoming over-extended, and then encountering very bad times, which hurt those least wealthy and least powerful the hardest, which then leads to conflicts that produce revolutions and/or civil wars. When these conflicts are over, a new world order is created and the cycle begins again.

He graphs one loop of this cycle below. It begins with a new world order, progresses into a period of peace, prosperity and growth of productive debt, followed by the growth of unproductive debt and increasing wealth gap, a debt bust and economic downturn, a period of desperate money printing and credit, revolutions and wars, debt and political restructuring, followed by a new world order. Take some time to consider where on this graph your nation finds itself. Doing so allows you to anticipate and prepare for what comes next.

Source, The Changing World Order, Ray Dalio

Source, The Changing World Order, Ray Dalio

During the last 500 years eleven leading powers have risen and fallen. His clear warning is that the US and much of the West have crested the top and are in the "printing money and credit" stage - with predictable consequences.

History shows that when an individual, organization, country or empire spends more than it earns, misery and turbulence are ahead. History also shows that countries that have higher percentages of people who who are self-sufficient tend to be more socially, politically and economically stable.

For example, we can readily observe the unprecedented growth of debt in the US (personal, corporate, local, state and national government). It is obvious to anyone who is paying attention - as is the public's growing financial dependence on the government. For decades, both political parties have devoted an ever-growing percentage of the nation's GDP to "transfer payments" (social benefits) to the population to buy their votes and keep them quiet, so that those holding political power can remain in office. While Republicans delight in holding themselves out as the party of "fiscal conservatives," the facts refute that claim. The US two-party system has been non-denominational in terms of fiscal irresponsibility. Here are their contributions to the national debt:

Johnson - D $42 billion

Nixon - R $121 billion

Ford - R $224 billion

Carter - D $229 billion

Reagan - R $1.9 trillion

Bush I - R $1.6 trillion

Clinton - D $1.4 trillion

Bush II - R $6.1 trillion

Obama - D $8.3 trillion

Trump - R $8.2 trillion

Biden - D $ to be determined

To be able to function properly every economy needs sound money. It "measures" the value of your labor and assets and the cost of everything you consume. It is supposed to act like a ruler. The problem is that governments always manipulate the ruler – it starts out being 12” long and then it shrinks to just 10” or 6". Everyone finds it increasingly difficult to know what to demand for their own labor, how much to save for their retirement, how much to invest in plant and equipment, and how much to pay for any good or service.

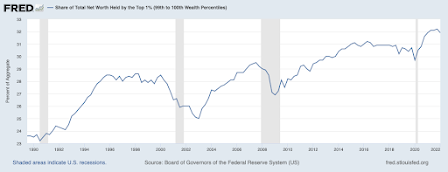

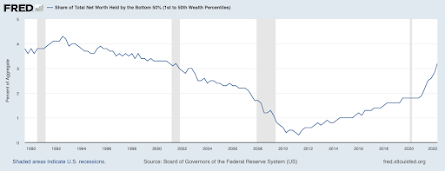

With today’s fiat money (i.e., having no intrinsic value) no one really knows what its value is today, will be tomorrow or how much of it they will need in thirty years for their retirement. History proves that governments always end up debasing their currencies to the great disadvantage of the working classes. The elite who own most of the assets are enriched by their rising prices, at the expense of the many who labor and own few of the assets.

As the percent of the population that is no longer self-sufficient grows, the government must increase its outlays to them in order to stave off social unrest. But directing an ever-growing percent of the national GDP to social benefits means there is less money to devote to capital improvements that are necessary to increase the production of goods and services. This results in declining productivity that, in turn, leads to falling international economic and geopolitical power.

History is replete with government defaults

Europeans are well versed in government defaults. They have experienced many of them. Americans however, scoff at the notion that the US would ever default, naively declaring that "we are the richest country in the world!" They have no comprehension of what it means to have a national debt of $31 trillion - and counting - and $170 trillion of unfunded obligations. It is axiomatic that current debt and future promises that cannot be paid in sound money will not be paid in sound money. The Federal Reserve Bank has partnered with the US Treasury to continuously debase the dollar through excessive money printing and by setting interest rates below the level of price inflation. They do this in order to make the government's growing debt more manageable in the near term. That is to say, inflation is not a "bug" in the US financial system. It is a "feature." The dollar has been devalued by 97% since the Fed was created in 1917. There has been an ongoing "soft" default by the US government for decades. It pays its debts with devalued money.

As to the commonly held belief that the US has never expressly defaulted on its monetary obligations, that too is mistaken. During the final stages of World War II most nations were in deep financial crises due to huge debts incurred to fight the war. In order to bring some resolution to erratic exchange rates between the national currencies, forty-four countries met at Bretton Woods, New Hampshire in July 1944. They agreed to a new monetary framework where the US dollar would be pegged to gold at $35/oz. and other currencies would be pegged to the dollar at set exchange rates that were to be maintained within a 1% band. This agreement succeeded in reducing exchange rate volatility and allowed for loans and grants between nations and from the World Bank, greatly facilitating trade among the participants and reconstruction after the war. In order to give the participating countries faith in the new system, it was agreed they could freely exchange US dollars they received in trade for US gold at the set rate.

The US dollar was chosen to be the base currency for a very practical reason. By supplying countries fighting Germany in two World Wars with arms, materials and food, the US had accumulated the largest gold hoard in history and other nations' gold holdings had been dramatically reduced. The US held over 20,000 tons of it. The Bretton Woods Agreement worked well for several decades. It came to an abrupt end on August 15, 1971 when US President Richard Nixon announced that the US would no longer exchange its gold for US dollars. He did so out of necessity - albeit a necessity created by the US government's gross mismanagement of its own economy.

The US imported goods from around the world and sellers of those goods were comfortable holding the dollars they received and investing them in US Treasury bonds. But by the late 1960's it became apparent to some (especially French government officials) that the number of dollars in circulation had vastly expanded and the value of those dollars was shrinking. Lyndon Johnson's "Great Society" consisted of vastly expanded social benefits and the US' quixotic war in Viet Nam was extremely costly. The US was paying these expenses by selling US bonds (creating debt) and printing dollars. As a result, foreign governments began to turn in their dollars for gold - first in dribbles and then in a flood. US gold holdings fell from 20,000 tons to just over 8,000 tons. Nixon understood that if US gold holdings were further depleted the dollar would suffer a loss of confidence and that would mean loss of international status and rapidly rising prices for imports. So, on August 15, 1971, he directed the US Treasury to default on the promise to exchange dollars for gold at the price of $35/oz.

However, defaulting on its obligation to accept dollars in exchange for gold did not solve the problem of the US' ever-growing debt and increasing difficulty in managing that debt. The US national debt has grown from next to nothing in 1970 to over $31 trillion today:

.png)

History shows that once a nation ceases to peg its currency to a real asset, it inevitably prints money with abandon, grossly devaluing it. The chart below shows the dollar's ever-declining purchasing power.

Progressives like to argue that this proves the "inherent flaw" of capitalism that can only be cured with more socialism. They are able to make this argument only by studiously ignoring the world around them. Putin and his oligarch supporters have cornered most of the wealth in Russia. President Maduro and his cronies hold the vast wealth in Venezuela. Castro and his supporters are the rich elite in Cuba. In all of these countries, those who get the short end of the stick are the middle and lower class workers whose wages always trail rising prices caused by the insider's debasement of the currency. The lesson to be learned is that it is not the form of government that causes wealth disparity. It is the presence of a strong centralized government that enables it.

The Shrinking Labor Force

Global banking giants are starting a 12-week digital dollar pilot with the Federal Reserve Bank of New York. Citigroup Inc., HSBC Holdings Pl, Mastercard Inc and Wells Fargo & Co are among the financial companies participating in the experiment alongside the New York Fed's innovation center, they said in a statement. The project, which is called the regulated liability network, will be conducted in a test environment and use simulated data, the New York Fed said. The pilot will test how banks using digital dollar tokens in a common database can help speed up payments.

One should recognize that the CBDC creates new opportunity for monetary policy. If we all had CBDC accounts instead of cash, in principle it might be possible to implement negative interest rates simply by shrinking balances in CBDC accounts.

The Investor's DilemmaWhat this essentially means is that any choice that remains and any degree of financial sovereignty that is left in the present system could be easily wiped out by CBDCs. And it's not only financial freedom that’s at stake: these centralized digital currencies can be used by governments to monitor, to control and even to directly punish dissenters, by blocking transactions, freezing their accounts or seizing they assets. Some might find that farfetched, but those are probably the same people who thought that China’s “Social Credit System” was implausible too, right up to the moment it was actually implemented.

If you, like many, are invested in a traditional 60/40 stock/bonds ratio, 2022 has been a disaster as this chart shows. While that strategy works much of the time, it comes with no guarantee and a few big negative surprises.

Rather than fall to 2-3 per cent by the end of next year, US core PCE inflation will probably prove rather sticky at around 4 per cent or above. This is what happens when an inflationary moment is allowed to get embedded into the economic system [due to Powell's gross misreading of the inflationary environment]. The world's most powerful central bank is now confronted with two unpleasant choices next year: crush growth and jobs to get to its 2 per cent target or publicly validate a higher inflation target and risk a new round of destabilized inflationary expectations.

Promising News on the Science Front

%20copy.png)