CAN CENTRAL BANKERS ORCHESTRATE "SOFT LANDINGS" FOR THEIR ECONOMIES

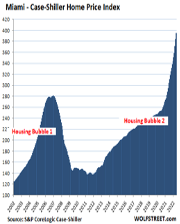

In deciding what to do next, Powell relies on the Fed's prized economic models to divine what will happen in response to their monetary inputs. So, it is worth reviewing how that has worked out, In 2008-9, the US was staggering through the bursting of a massive real estate bubble brought about by the Fed's low interest rates and its abject failure to oversee the actions of the big Wall Street banks. The Fed did not see that crisis coming. Fed chair Ben Bernanke assured us that housing was not in a bubble and the industry was sound because housing prices did not fall. After the bubble catastrophically burst, the Fed embarked on a new, frenzied injection of money into the economy to bail out the banking industry from its staggering incompetence. Curiously, the major media never demanded that the Fed, whose job it was to monitor the activities and financial health of those banks, explain how it had allowed the situation to get so badly out of hand. Following that disaster, Bernanke had the gall to write a book titled "The Courage To Act." His "courage" consisted of creating trillions of new dollars to lavish on (bail out) the very banks he had failed to supervise.

When Covid appeared, the government shut down the US economy. Whether that was wise or monumentally foolish will be debated for a long time. The Fed and Congress spent even more trillions of dollars to bail out the banks (again), airlines, the states, and the forcibly unemployed. We were assured that those vast sums of new money would not lead to price inflation. Predictably, consumers spent their stimulus dollars on goods because the service industry was comatose - due to the government ordered shut-downs. But goods were not being produced as factories had ben forced to close. To the Fed's and Congress' great astonishment, prices began to rise due to product shortages and shipping delays - the latter also caused by government ordered shutdowns of shippers, longshoremen, and truckers. Mr. Powell insisted for a long time that rising prices were "transitory" before he was finally forced to admit that the inflation horse was well out of the barn. As the Covid "stimulus" spending continued, vast sums of money flowed into the stock market and other assets and - Bob's your uncle - asset prices soared.

If this history fails to deter you from believing that Powell and his fellow merry money printers around the world are firmly in control of the situation, that belief should have been finally put to rest by his admission that,

"We [now] understand better how little we understand about inflation."

Evidently, it still does not dawn on him that shoveling $8 trillion into the US economy might have had some pernicious side effects - like soaring price inflation. How confident should you be that he and other central bankers will be able to deliver us to the promised land of a healthy economy with normal, positive real interest rates? Consider: we are faced with two irrefutable facts: 1) if the Fed was truly up to the task of managing the economy we would not now have the worst price inflation in 41 years, the worst first six months in the stock market in 52 years, the worst bond market in 224 years and 2) every government intervention in the market - even when done with the best of intentions - always has the effect of distorting the normal functioning of that market, for which you always end up paying a dear price. Finally, remember Fed former chair, Janet Yellen's, memorable pronouncement that,

"As for financial crises...well, haha, it would perhaps be presumptuous to say that a financial crisis will never occur again, but with our current knowledge and tools for prudential monetary policy, certainly we can say that a financial crisis will not occur in our lifetimes."

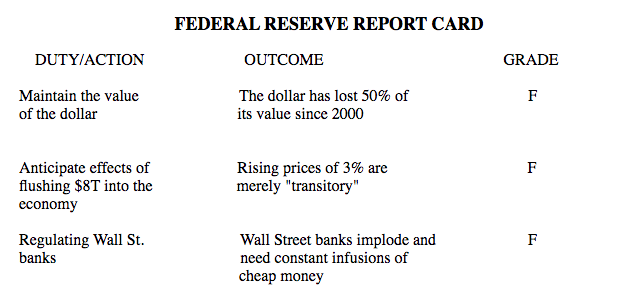

Let us take a moment to reflect on the Fed's performance to date.

The Fed is not the only disruptor of the US economy. Upon taking office President Biden proudly cancelled the XL pipeline that would have brought oil to the US, from its friendly democratic neighbor to the north, banned oil leases on federal lands, and shut down leasing for offshore oil development. He made clear that the oil and gas industries were to be made redundant in the not too distant future. Result? Oil companies were discouraged from investing billions of dollars in development, extraction and replacing refining capacity for fossil fuels. Consequence? Biden is forced to go hat-in-hand and plead with ruthless dictators in Saudi Arabia and Venezuela to increase their oil production. He also drew down the Strategic Petroleum Reserve that was created to provide the military with fuel in case of war-time shortages. With Russia shutting off gas to Europe, vast quantities of US LNG gas are being shipped to Europe to save it from a coming winter catastrophe. Thus, gas prices have surged.

While is is undoubtedly a good idea to find new sources of dense energy to power industries, transport people and goods, and heat and cool our homes into the future, it is the height of stupidity to cut back existing sources of power before getting the new sources on line. This was the bad choice made by Germany when it decided to close all of its nuclear power plants (only three remain in operation and they are scheduled to close by year end) that supplied much of the power to run its vaunted industries. The foolishness of that political decision is now manifest because existing sources of "green energy" fail to fill the shortfall - by a lot. Germany became dependent on the good graces of Russia to supply gas until that future day German energy independence might be achieved. That was a monumental, strategic error. The EU is in an energy crisis and debating how they will ration gas this winter. That will result in the shuttering of an unknown percent of German, French and other nations' industries, inevitably leading to massive layoffs. It is discussing forcing 15% gas reductions on all of its number nations, infuriating those that are better prepared. Is your government pursing a similar energy policy? If so, you better buy that duvet and wood stove before they are sold out.

The media are beginning to run stories that price inflation has peaked as evidenced by falling petrol prices. A peek beneath the economic bonnet reveals that the US is not out of the woods. It is true that gasoline prices have come down from their recent highs but they are still well above the start of the year and are causing great pain among the middle and lower class families. The Fed's favored "16% Trimmed Mean CPI Index" shows prices rising dramatically.

"Sticky Price CPI" - expenses that are slow to fall, such as wages - remain very elevated.

Data show that labor productivity is declining (red line) while wages are escalating (blue line). This promises higher prices to come because less is being produced and at a higher cost.

A very troubling fact is that despite a growing US population, the number of people in the labor force is dramatically below trend. The labor participation rate has fallen to 62.1%.

The rising wages referred to above (6.2% year over year) still trail price inflation that is now reported at 8.5% (but is over 16% in real terms). The inevitable result is that wage-earning consumers will have to start dialing back purchases due to their shrinking real paychecks. These are hallmarks of "stagflation," the dreaded condition of combined higher price inflation and slowing economic growth. While consumers are still spending, albeit at a lower rate, they are doing so by "dis-saving" and loading up their credit cards. That cannot go on forever. US household debt has risen to $16.2T, which includes mortgages and credit card debt, the latter of which increased by 13% in Q2 - the largest increase in 20 years. To induce continued consumer spending retailers are cutting prices to clear out inventories but that leads to falling profits at Walmart, Target and others that may lead to a new round of layoffs.

While Democratic politicians insist that the US is not in a recession (commonly defined as two consecutive quarters of dealing GDP growth) it is clear that the US economy is not in a good place having contracted .9% in Q1 and 1.6% in Q2. Housing, a mainstay of the the US economy is confronted with high home prices and rising mortgage rates. This inevitably leads to falling sales. The green line below reflects average home prices and the black line represents housing "affordability." Rising interest rates hurt sales, pressuring prices to drop.

Rising rates also discourage new construction making fewer units available.

It is indisputable that the Fed has created a second, and far more serious, housing bubble with its $8T of money printing as seen in these charts from Wolfstreet. Will this bubble suffer the same fate as the first housing bubble? Why would it not?

Commercial real estate is facing a similar crisis with companies acquiescing to work-from-home demands from their employees. Salesforce, headquartered in the biggest office tower in San Fransisco put half of its office space (400,000 sq ft) on the market for sublease. Dallas and Houston already have over 30% vacant commercial space. Meta, that now allows most employees to work from home, cancelled plans for 300,000 sq. ft of new space in Manhattan. Amazon is cancelling plans for six office buildings in Bellevue, Washington.

Much is written about former Fed chair Paul Volker's defeat of rampant inflation in the 1980's by raising interest rates to 20%. Will Jay Powell muster up the nerve to do the same? Not likely. The facts are dramatically different today. Consider the size of the Fed's balance sheet today as a percentage of US GDP compared to the 1980's.

1986: 5.9%

2021: 36.6%

To achieve the same result as Volker, Powell would have to inflict vastly more pain on the economy than did his predecessor. He has shown no willingness to do that. Where does that leave us? Ray Dalio describes the Fed's woeful options.

In my opinion, we are clearly in phase 3 of the classic Big Debt Cycle when the central bank faces the choice between a) allowing money and credit to tighten and interest rates to rise, which is depressing especially for those most over-indebted, and b) printing money to help the most indebted service their debts and keeping real interest rates artificially low, which devalues their money, heightens inflation, and increases debt, which makes the problem worse down the road.

If the Fed is out of good options, can private industry right this listing ship? Q-2's worker productivity came in at -4.7%, on top of the -7.7% decline posted in Q-1. Together they amount to the worst back-to-back productivity declines ever reported. The blue line below reports falling productivity while the red line reports growing numbers of workers. More workers producing fewer goods virtually guarantees future price rises (more inflation not less). Unit labor costs jumped 10.8% in Q-2, reflecting a 5.7% increase in hourly compensation compared to the just referenced 4.7% decrease in productivity. One would like to see these lines in tandem.

Private industry cannot overcome fourteen years of disastrous Fed policy and staggering government budget deficits. Mr. Dalio opines that a price will be paid for those years of monetary and fiscal malfeasance.

Might the US Congress come up with smart solutions to address these problems? No, they will always do what is politically expedient (i.e., what will get them re-elected). "Exhibit A" is the farcically named "Inflation Reduction Act" that will lead to $739B of new spending (more realistically $1T) and the "Chips" Act that was intended to support the domestic computer chip manufacturing industry with $52B that exploded to $280B due to Congressional "earmarks" (unrelated add-ons favoring Congresss' political supporters).

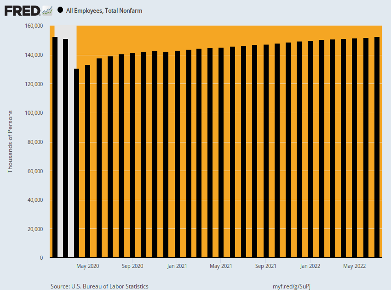

One quickly concludes that politicians cannot be trusted to bring in the mail much less address serious problems. They are constantly "spinning" negative facts into something that sounds positive. For example, President Biden has repeatedly crowed that his administration has "created millions" of jobs for the economy. It is true that millions of people have returned to work after the government forced them into layoffs during Covid. But the fact they they returned to work did not make their jobs "newly created." This chart reveals their slow return to their old jobs.

The problem in a nutshell is that between the post-dot com crash and subsequent money-printing spree and flood of central bank credit in 2020, global central bank balances soared from $7T to nearly $42T. That 9X increase in the money supply bought just a 2X growth in GDP. The rest went into the pockets of the elites and created asset bubble now at risk of popping.

The European Economies

Europe is in deep crisis. In France, food and electricity prices are up 7.6% and 28% year over year. It currently has the most expensive electricity in Europe. Half of the French nuclear power fleet is out of action. Twelve reactors are closed because of corrosion. Five more on the Rhone and the Garrone rivers are cutting power because of low water levels. Inflation in some smaller EU countries is approaching 20%. German retail sales suffered their fastest drop in almost 30 years and the country is certainly in recession. Its Rhine River level is well down - a huge problem for the internal transport of goods. A key point on the waterway west of Frankfurt will soon become impassable for barges carrying coal, oil, and gas. Italy is in political crisis with the second resignation of its Prime Minister, Mario Draghi.

At more than 150% of GDP, Italy's debt is far larger than any other major economy in the currency area. Spain's ratio is 118% of output and France's is 113%. Germany is far less indebted at 69%. Because of these vast differentials, it has been exceedingly difficult for the European Central Bank to devise a plan that fights rising inflation without also sinking the large debtor nations. Evans-Pritchard at the Telegraph describes another problem.

Negative rates and QE may have helped the Latin bloc but they have been poisonous for Germany, where they have wrecked the local cooperative and savings banks that underpin the Mittelstand (industrial) family firms. The working class keeps their savings in deposit accounts. Almost half the population rents rather than owning property, and few of them have any financial assets. Nowhere more than Germany has the Lumpenproletariat been left behind by the inequalities of QE asset enrichment.

Recognizing the impossibility of enforcing a uniform monetary policy on all of the EU members, the ECB has recently claimed the authority (without agreement by the EU member nations) to engage in non-uniform monetary treatment of the EU member nations. It created what it calls the Transmission Protection Instrument (TPI). This scheme would allow it to roll some government bonds (i.e, German and French) off its balance sheet with the express purpose of buying more Italian bonds than is permitted under its current authority, This is a monetary strategy that Germany will not likely tolerate. It agreed to join the union on the express basis that it was not going to financially support other member nations, that is, the EU was not to become a fiscal union with the sharing of expenses. Germany's constitutional court has repeatedly held that no EU law requiring Germany to fund other member nations is enforceable on Germany without the express agreement of the German legislature (Bundestag). Evans-Pritchard reports,

[T]he sheer existence of the pool [TPI] is enough to infuriate critics in Germany. Christian Democrat (CDU) leader Friedrich Merz accused the ECB of illegally assuming the power to level the borrowing costs of unreformed and profligate states (in his eyes) by targeted bond purchases, a sin even beyond the excesses of QE. "This is the last step in the financing of budgets with central bank money," he said.Marcel Fratzscher, head of Germany's Institute of Economic Research, said there seems to be "almost no constraint" on how the the ECB can act. This becomes an issue of democracy.The anti-fragmentation tool gives the ECB sweeping powers to decide when to rescue a country and stave off default, and when to leave it defenseless. By this mechanism, it can dictate budget policies, or enforce pension reforms, or order changes to labor law, without a democratic mandate. It can keep obedient pro-EU governments in power, and topple those with a different ideology à la Grecque.This is not new. The ECB brought down Italy's Silvio Berlusconi in 2011 by manipulating yields and installed a Eurocrat more to their liking, as was once explained to me in vivid detail by a disgusted ex-member of the governing council. [Critics of the EU plan] said it was reckless anthropology to foist monetary union on states with starkly different societies and histories, different commercial practices and housing markets, different debt burdens and sensitivities to interest rates, and different trade exposure. They warned that this one-size-fits-all regime would lead to chronic intra-EU friction, punctuated by crises at cyclical turning points. And so it has proved. The difference now is that the ECB's power is formalized and limitless. What happened last week takes Europe closer to a technocrat dystopia under a querulous central bank priesthood.

The immediate problem is that Italian bond rates are rising and the ECB may quickly be forced to become their buyer of last resort to keep the rates in check. If the ECB is unable to buy more Italian bonds, that could force Italy to withdraw from the EU, reinstate the lira and then devalue it. "Antifragmentation" is simply code for keeping Italy from having to leave. But German views on the subject cannot be ignored. Daniel Johnson at the Telegraph writes,

German problems are Euro problems. We've already had a demonstration of the impact the Kremlin's gas manipulation can have on Western leaders. Nord Stream 1 has been running below capacity since June, ostensibly because of a turbine being repaired in Canada but held up by sanctions. After EU pressure was applied on Ottawa, the Canadians returned the turbine, provoking furious protests from Kyiv.At the heart of this concession was Europe's largest economy, Germany, whose industrial base is a huge gas guzzler. A single plant, the BASF chemical giant's headquarters in Ludwigshafen, consumes half as much gas as the whole of Denmark. If Putin were to turn off the tap, the consequences for Berlin would be "the most severe economic crisis since the end of the Second World War," according to BASF's chief, Martin Brudermüller.A conservative estimate is that the German economy would contract by 6 percent. That is the consequences of the Ostpolitik- what others might call opportunistic naivety towards Russia - pursued with myopic zeal by former German chancellors Gerhard Schröder and Angela Merkel. The current chancellor, Olaf Scholz, hasn't been much better. He continues to prevaricate as Europe prepares to freeze. He was happy to burn vast quantities of coal to deal with the recent heatwave, but refuses to restart decommissioned nuclear plants to placate his Green coalition partners.Around him, the dream of a strong and united European Union is crumbling. Italy has seen its ruling coalition fall apart. Prime Minister Draghi, in confirming his resignation, despaired that some in the Italian establishment were eager to appease Russian demands. With elections coming, populists such as the Brothers of Italy will exploit the energy crisis to steer the country on a pro-Russian course. And in France, Emmanuel Macron is as good as a lame duck, having lost his parliamentary majority last month.

The UK Economy

The Bank of England recently opined that the UK will see 13% inflation by October (after having estimated in May that it would not exceed 10%) and that British household incomes will shrink in real terms by 3.5% as they suffer soaring energy costs, rail strikes, rising tax rates, cancelled flights, and water restrictions due to recent drought. Is the UK water crisis a result of global warming? The Met Office (weather service) reports that there has been no significant change in rainfall levels since 1840 and the past 30 years have been 10 per cent wetter than the previous 30. Rather, the problem seems to be that the water system loses 3 billion liters of water a day due to service leaks.

In response to the ongoing inflation, the BOE raised rates a timid .5% to 1.75% that results in real interest rates of negative 9.25%, further fanning inflation. The National Institute for Economic and Social Research reports that some 5.3m UK households will have no savings at all by 2024 - one in every five. Another 1.7m will be left with less than two months of savings in the bank, making them extremely vulnerable. A recent punch in the British nose is Moody's threat to downgrade UK government bonds (known as Gilts). If that occurs, the UK will be forced to raise rates even faster to attract investors or they will have to be monetized by the Bank of England (print money to fund the government). If that comes to pass, it always leads to tears.

Conclusion

The Western world is facing many serious crises - as is China. The good news is that we are not at world war. However, it will take dedicated people of great insight to solve these problems that have been decades in the making. Such people exist. What is the chance they will find their way into positions of power and do what is necessary? When one considers the sorry cast of characters offered up to us by major political parties, the odds seem depressingly slim.

Important message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investments objectives, and risk tolerance.

Ⓒ All rights reserved 2022