WAR, SHORTAGES, RAMPANT INFLATION, POLITICAL AND MONETARY DYSFUNCTION

We humans have always faced an endless series of disasters. Many are manmade: wars, inflation and social deterioration. Some are served up by nature: viruses, extreme weather, and large meteor impacts. Not infrequently, humans and nature conspire to create catastrophes: forest fires, bursting dams and earthquakes beneath poorly designed nuclear power plants. Today’s major problems include the war in Ukraine, supply line disruptions, inflation and political dysfunction. Each of these is brought to us by the world’s “elites.” We do not use that term in a flattering sense suggesting great leadership and wisdom. To the contrary, the “elites” include sociopaths (Vlad Putin), arrogant grandees (Emmanuel Macron), rules-for-thee but not-for-me (Boris Johnson) and teleprompter-reading talking heads (Joe Biden).

Having flown to Davos, Switzerland in hundreds of their private jets these “elites” have gathered for the purpose of hectoring the rest of us to turn down our furnace thermostats, turn up our air conditioner thermostats, and travel less to ease the “carbon load” on the planet. Bill Bonner, having recently visited Paris reports,

Inflation Is Insidious – It Rots Everything to The Core

Prices there are rising, too. And the elite class – the leftish techno-snobs who run the country – are getting bolder. Their program: make life more and more miserable for the common man as they pursue their own jackass goals. The educated, enlightened, well-off Parisian believes the world would be a better place if the uneducated, unenlightened, struggling yokels were kept in their place. Specifically, he wants them to use less energy, to stay at home, turn down the heat and not to make a fuss about rising prices.

It is clear that the “elite” get to call the shots. The Russian people did not decide to invade Ukraine - Putin did. Western consumers did not vote to stretch supply lines of essential goods to our political adversaries (Russian oil, gas and fertilizers, and Chinese goods) - corporate executives did. Much of the world is now directly or indirectly paying the price of Putin’s war. The short-term result of “trade globalization” was “Everyday Low Prices” at Walmart for everything from cotton socks to dishwashers. The long-term results have been closed western factories, laid off western workers and enriched autocratic empires like China - with us ever more dependent on them. When a nation relies on its international political adversaries to supply essential drug stocks, enriched uranium for its nuclear power plants, gas, oil, rare earth metals and electronics necessary for its defensive weapon systems, that nation’s elites have made a deal with the devil for which the general citizenry (you) will pay a dear price.

Even though you did not cause any of these problems, you have to contend with them. You pay more for gas and oil, food, clothing, homes, autos and everything else. You did not cause prices to rocket higher. The PhD elites at the world’s central banks did when they flooded their economies with trillions of dollars (pounds, euros, yen, etc.) of fresh-baked money after the political elites sent workers home for two years during Covid thereby shutting down supply lines. They always fail to consider Newton’s Third Law: for every action there is an equal and opposite reaction. Their goal was to look like they were “doing something” to revitalize their economies that they had previously euthanized. US Government debt soared from $23 trillion at the start of 2020 to more than $30 trillion today. M2 – a broad measure of the stock of U.S. dollars – rose from $15.4 trillion in January 2020 to $21.8 trillion in May 2022. More than 40% of U.S. dollars now in existence were created in the last two years, vastly enriching the 1%. You are now paying the long-term, inevitable inflationary costs of their actions.

Inflation Is Insidious – It Rots Everything to The Core

In our last issue we discussed the Cantillon Effect whereby the first people to get access to newly printed money (the “elite”) benefit the most and everyone thereafter benefits far less or not at all. That is because prices rise as the new money begins to flow through the economy. The insiders profit mightily. Jamie Dimon, Chairman and CEO of JP Morgan Bank, is still hoping to be awarded another $30 million in retention bonus despite JPM shareholders having voted resoundingly against the proposal and after JPM pleaded guilty to five felony counts of fraud and price fixing and paid billions of dollars in fines and penalties during his stewardship. All the while, the average worker has fallen ever farther behind. The worker always loses because his/her small wage increases always lag price inflation and, to their further detriment, their wage increases add to the cost of goods and services they must purchase.

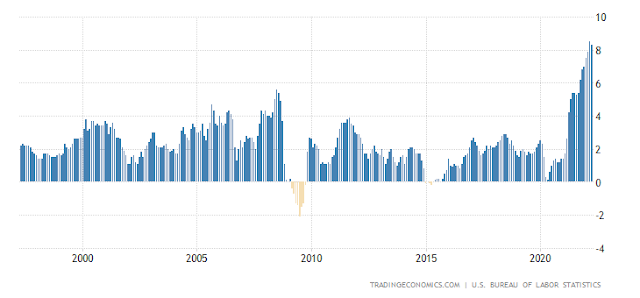

US prices increased 8.3% in April compared to a year ago. While slightly lower than the previous month’s increase of 8.5%, it is still a disaster for millions of people living on wage income, fixed income and retirement savings. Say you managed to have saved as of last April $100,000 through decades of thrift. Today your savings are worth just $91,700. But that does not begin to tell the story. All prior years’ inflation has cumulatively eroded your savings vastly beyond last year’s 8.3%. The twenty-five-year chart on the top of the next page shows the annual CPI as calculated by the Bureau of Labor Statistics. Bear in mind that real price inflation rates are substantially higher, so your loss of savings has been substantially greater. This is why saving enough money to support oneself in retirement is now virtually impossible for all but the wealthy.

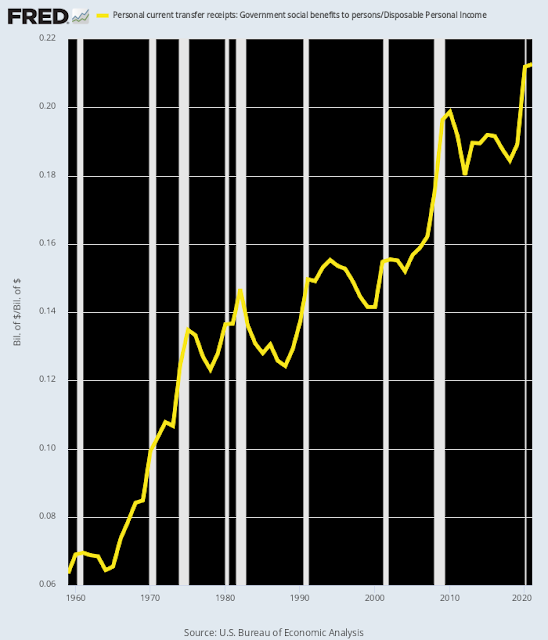

The inevitable result of this ongoing loss of real wages is that governments are forced to spend an ever-increasing amount of money supporting the people it has beggared through inflation. This graph below shows the steady growth in “transfer” (welfare) payments as a percentage of US disposable income.

For those fortunate enough to be able to invest in the stock market, there is an equally perverse result. The chart on the next page shows the “nominal” return on the S&P from 2000 to the present (blue line). Thus, $1000 invested in 2000 rose to just under $4000 in 2022. But much of that gain is an illusion. Adjusted for inflation (again based on low-ball, government-issued CPI calculations) the “real” return is just $2319. If you had one million dollars invested, the numbers would be $3,916,000 in “nominal” profits but just $2,319,000 in “real” profits. On top of the “inflation tax” you pay daily for everything you buy; you will be forced to pay a capital gain tax on $1,597,000 of phantom income – or some $375,295! In this way your government continuously embezzles your money through inflation.

So too, if you invest in a 10-year Treasury bond, your principal shrinks in value every year AND you pay tax on your pathetic interest income. Government bonds are a lose-lose proposition. Warren Buffett: “Inflation swindles the bond investor too. It swindles the person who keeps their cash under their mattress. It swindles almost everybody,” Here is how it swindles you daily (food price increases over last year).

Spaghetti/Macaroni: 10.3%

Lettuce: 12.0%

Milk: 16.4%

Orange juice: 17.2%

Ham: 17.7%

Butter: 17.9%

Bacon: 19.4%

Chicken: 20.3%

Beef: 24.2%

Sugar: 32.2%

Eggs: 33.8%

Hot dogs: 37.1%

- Lamb: 43.8%

- Soybean oil: 60.7%

- Coffee: 70.6%

Not only have US consumer prices been inexorably rising for many months, but US producer prices have also been steadily rising. The chart on the next page shows this relentless rise. Rising producer prices inevitably lead to higher consumer prices.

The million-dollar question is how could Fed Chairman Powell have looked at this chart and concluded that inflation was “transitory” and would soon return to the desired 2% level? It does not take a Fed PhD economist to spot the trend (but none of them did).

The next chart shows US industrial production going back fourteen years. Today, US production is just past the level that existed in 2014. This equates to a paltry 0.26% per annum growth rate over the last 7 ½ years - and just 0.21% over the last 15 years. For perspective, the growth rate averaged 3.52% for the last fifty years of the 20th century (17x higher). Why the difference? Globalization and the offshoring of US jobs crushed US production.

Fed chairman Powell, who is directly responsible for much of today’s raging inflation, was just approved by the Senate to serve another term. Is there any hope for our salvation? Shan Nagasundaram, writing recently for Mises.org is not optimistic,

Never in the history of the world has the financial well-being of so many been tied to the economic competence of so few. Given how wrong the US Fed has been in its forecasts of transitory inflation, one would hope that Fed officials would have questioned some of their basic assumptions, which led to such dramatically erroneous conclusions. Yet, they continue down the path of mistaking bubbles for growth, extremely frothy market valuations for solid fundamentals and the cheery market consensus for a stable equilibrium. The fundamentals of the US Economy have been deteriorating for at least two decades, and it was the apparent low consumer price inflation despite all the monetary inflation that masked the disease. Economists, investors, and the general public have been mistaking the equity, real estate, and bond bubbles (which are a direct consequence of the monetary inflation) as indicative of a sustainable economy.The deficit of the US government for 2022 would be to the tune of $3 trillion. If the US Fed, which has been the biggest buyer of Treasuries in the last few years, now becomes the second biggest seller (after the US Treasury, of course) who is going to be the buyer? Even assuming they can find a buyer at what price can such transactions be effected? The biggest buyers of these treasuries before the US Fed stepped in were the central banks of China, Russia and Saudi Arabia. It is doubtful that these buyers will return to the table for the foreseeable future. Not even the other “friendlier” central banks such as the Bank of Japan or the European Central Bank are going to step in, as they have their own inflation problems to deal with.The massive misallocations of capital due to artificially low interest rates of the last few decades are in the early stages of being rectified. Such a correction from a position of extreme vulnerability, like the US economy is in today (i.e., trillion-dollar trade and budget deficits), has never happened, the end game is going to be one for the history books. The US Fed will probably start the QT2 process in May, which will lead to a near breakdown of the financial system within a few weeks or months.QT1 in 2018 lasted for nearly a year, but the leverage and the imbalances within the system are far greater today than it was in 2018. QT2 will then be replaced with QE (to infinity) in short order “to save the economy.”

As to the question of “who is going to be the buyer” of the coming flood of US Treasuries, we need to remember that every Treasury about to be unloaded by the Fed and sold by the Treasury pays a negative real rate of interest. How many of the following categories of existing bond holders are going to be willing to stump up for more guaranteed losses of principal?

Of course, the US is not alone in suffering the scourge of inflation. The UK’s CPI was up 9% in April following 7% in March. Consumer prices are at a 40-year high and consumer confidence was last this low in 1974 when Margaret Thatcher was living at Number 10. Gas and electric costs are about to surge 54%. While UK retail sales have reported an increase, much of that growth was due to higher food and energy costs rather than more sales. The EU is suffering and can be expected to suffer further price inflation as producer prices have skyrocketed. Meanwhile Germany is making plans to ration gas to its industry if its supply is abruptly shut off from Russia.

Lacy Hunt writes, “we are in pre-recession; we are going into recession and where the Fed goes from there, I’m not sure.” Powell has laid out a timeline for reducing its nearly $9 trillion balance sheet. Beginning June 1st, the Fed will start conducting monthly sales of $47.5 billion ($30 billion of Treasury securities and $17.5 billion of mortgages) through August, and then ramp up the bond-selling pace to $95 billion a month this fall if the economy and markets do not collapse. Stay tuned as the last time the Fed tried to do this, the markets shrieked, and the Fed quickly buckled. Powell’s grasp on the economy is not encouraging. He recently observed that, “the markets are orderly, they’re functioning.” Wall Street on Parade noted,

He has a law degree, not an economics degree. Thus, his misdiagnosis that inflation would be transitory already makes his judgement suspect. To now suggest that the stock market is “orderly” and “functioning” in the face of a mountain of evidence to the contrary makes Powell look completely out-of-touch with reality. Crypto assets, which have been widely called a pyramid scheme based on the Greater Fool theory but were nonetheless allowed to spread throughout U.S. markets, had climbed to a market value of $2.9 trillion last November. That’s now a $1.4 trillion market cap with $1.5 trillion of investors’ money going poof in six months. That’s certainly not an orderly market.Powell (and Biden) have both asserted that the US economy is “strong.” Study the next chart showing the progress of “real final sales” of domestic products. “Strong” is not a word that comes to mind to describe these data.

How has the Fed been so disastrously wrong about the state of the economy? There is a ready explanation. The members of the Fed’s Open Market Committee (who get to vote on Fed policy) are all cut from the same cloth and have the same (none) experience in the real world of business and finance. John Williams, head of the NY Fed; Jim Bullard, head of the St. Louis Fed; Esther George, head of the Kansas City Fed; Mary Daly, head of the San Francisco Fed, and Loretta Mester of the Philly Fed have never held jobs outside of the Federal Reserve system. Charles Evans, head of the Chicago Fed and Raphael Bostic, head of the Atlanta Fed, have never held jobs outside of the Federal Reserve system and academia. Kenneth Montgomery, interim head of the Boston Fed and Meredith Black, interim head of the Dallas Fed (following the resignations in disgrace of Eric Rosengren and Rob Kaplan over insider trading scandals) have never held a job outside of the Federal Reserve system. Patrick Harker, head of the Philadelphia Fed, is an academia and government lifer. They are, as Wall Street on Parade describes them, an “inbred, arrogant, frequently wrong but never in doubt priesthood of central economic planners.” It comes as no surprise they never break out of “group think.”

If you want to keep score with what other central banks are doing as the current crises unfold, the following chart is helpful.

Crypto assets to the rescue?

To stay one step ahead of inflation and falling markets, some investors bought one or more of the many digital currencies available. These have long been touted as a way to escape the foibles of fiat currencies. Bitcoin, for example, has had several meteoric rises (followed by breathtaking falls). Seeking to address such stomach-churning volatility, several coin developers have come up with the idea of a “stable coin” that is pegged in value to a real asset, such as the US dollar. The premise is appealing. You can get money out of the banking system, enhance your financial privacy, and send money around the world on short notice and at virtually no cost. The TerraUSD stable coin ostensibly had all these desirable features and was established to link its value to the US dollar. However, it is not backed by actual dollars. Instead, it is designed to automatically offset any fall in value through its relationship to a “governance token,” the Luna, that was backed with other digital currencies (not dollars). The business plan seemed foolproof: when necessary, the Luna Foundation would sell these other digital currencies and buy the Terra thereby supporting its value. The plan worked perfectly – until it didn’t. The Terra USD fell to $0.06 (six cents) on May 16th causing TerraUSD holders to lose over $45 billion almost overnight. As the TerraUSD sank in value, its fall sent shockwaves through the general cryptocurrency market wiping out over $300 billion in value. But that is not all the bad news concerning digital currencies.

They have also been subject to repeated thefts despite their purported invulnerability due to “blockchain” technology. For example, in early 2014, hackers stole almost $500,000,000 of bitcoins from customers at Mt.Gox in Tokyo. In January 2018 hackers stole coins worth around $530,000,000 from Coincheck in Tokyo. $610,000,000 was hacked from the Poly Network, in August 2021. Owners of Ether coins lost $320,000,000 from Wormhole in February this year and $615,000,000 from Axie Infinity in March.

How about those high-flying, high-tech NFT’s (non-fungible tokens) about which we have written? Surely, they have held their own against the demon inflation. In March 2021, Iranian “investor,” Sina Estavi, bought the NFT of Jack Dorsey’s first tweet ever issued on Twitter. Estavi paid $2.9 million for this piece of digital history. Last month he decided to put it up for sale at auction at the suggested price of $48 million. At the end of the auction he had received seven bids. The highest was $277. This puts into sharp focus a piece of investing wisdom from Warren Buffett: “Price is what you pay, value is what you get.” There is sometimes little, if any, correlation between the two.

Joe Biden Ad Libs Again; Diplomats Shudder

On his recent visit to Japan to meet with Prime Minister Fumio Kishida, President Biden appeared at a news conference.

"You didn't want to get involved in the Ukraine conflict militarily for obvious reasons. Are you willing to get involved militarily to defend Taiwan if it comes to that?" a reporter asked."Yes," Biden replied.The surprised reporter pressed further, "You are?""That's the commitment we made," the president said.

For decades the US has made only ambiguous commitments concerning its support of Taiwan and for good reason. China has forcibly and repeatedly declared that Taiwan is a part of China. President Xi Jinping has frequently referenced its impending “return” to Chinese control. Biden threw a cat amongst the pigeons with his off-hand remark. Chinese officials were prompt with their denunciations and explicitly warned that any US sailors coming to the aid of Taiwan will find their place on the bottom of the South China Sea. What "commitment" Biden was talking about remains a complete mystery because there is no mutual defense treaty between the US and Taiwan. President Carter terminated the last US/Taiwan Mutual Defense Treaty/MDT) in 1979. As is now standard operating procedure, White House officials quickly scrambled to walk-back the president's clear affirmation that he would send a US military force against superpower China in the event of an invasion. They quickly confirmed that the US policy "has not changed."

It is obvious that should hostilities flare between China and Taiwan, the US would be in no position to aid Taiwan as it has Ukraine. US armaments are readily sent into Ukraine from adjacent NATO member Poland and other countries on its western flank. Any armaments going to Taiwan would have to go by sea and would be highly vulnerable to attack. This means that any military support the US intends to supply to Taiwan must be delivered before hostilities begin.

A Final Note on Ukraine

Former diplomate and highly regarded political consultant, Henry Kissinger, recently reminded the World Economic Forum that Russia has been an essential part of Europe for 400 years and has been the guarantor of the European balance of power structure at critical times. He added that European leaders should not lose sight of the longer-term relationship, nor should they risk pushing Russia into a permanent alliance with China. He concluded with the hope that, “the Ukrainians will match the heroism they have shown with wisdom,” adding that the proper role for Ukraine is to be a neutral buffer state rather than the frontier of Europe - as we wrote in our March letter.

© All rights reserved 2022

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance.