“Everyone wants to live at the expense of the state. They forget that the state lives at the expense of everyone.” - Frederic Bastiat

There are many other examples of high-level stupidity. For example, since 2008, the US Federal Reserve Bank has printed five trillion dollars and ratcheted interest rates down to levels not seen in 4000 years. This led to massive bubbles in virtually every asset class, vastly magnified the disparity between the rich and poor, and has driven consumer prices dramatically higher. The Fed, with the active encouragement of both Presidents Trump and Biden, has become the US version of the former soviet-style central economic planners. Anyone with a high school education knows how well centrally planned economies do. History is full of them, including the former USSR, Mao’s China, Cuba, and Venezuela.

To show just how much Joe Biden’s mind seems to operate in some alternate universe, he has recently informed us that the $3.5 trillion of additional government spending over the next several years will cost “nothing.”Why nothing? Because over $2.1 trillion will be covered by taxing the rich and large corporations. The remaining difference between $3.5 trillion of greater spending and $2.1 trillion of increased taxes will materialize through some magic formula of government investing in infrastructure, alternative energy sources, and people.Biden said, “Every time I hear this is going to cost A, B, C, D—the truth is, based on a commitment that I made, it’s going to cost nothing … because we are going to raise the revenue.”

Does Biden really believe that spending trillions of dollars costs “zero?” The result is not difficult to predict: more spending will cause higher prices that will cause more hardship for millions of people who are still struggling to get past the Covid crisis. Higher taxes on corporations get passed on to consumers the same as higher material and labor costs get passed on. So, it is not “corporations and millionaires and billionaires” who will pay the price for the proposed government largess. It is all consumers. Jay Powell tells us not to be alarmed by the recently announced price inflation of 6.2%. He assures us that it is “transitory.” Of course he said the same thing when it was 2.1%.

When we look at the un-manipulated reporting of prices (blue line below) it is easy to see that our government officials are trying to pull the wool over our eyes with their claim that official inflation (red line) is nothing to worry about. It is only 6.2% if you do not have to eat, drive to work, heat and light your home or shelter your family. Gasoline prices have nearly doubled; food and housing costs are soaring, natural gas is about to explode come the winter months.

Columnist Paul Kasriel explains the problem,

In the 17 months starting with April 2020 and running through August 2021, roughly $2.7 trillion in Covid-related income transfers were paid to households by the federal government. In this same 17-month period, the Federal Reserve and the commercial banking system, combined, increased their holdings of US Treasury securities by about $2.8 trillion. So, all of the Covid-related federal government income-transfer payments, and then some, were funded by the Federal Reserve and the commercial banking system. Did it stimulate household nominal spending? In terms of nominal retail sales of consumer goods, it sure did. But while retail sales growth was soaring after the helicopter drop of money, growth in the production of consumer goods was not keeping pace. What happens when demand is growing faster than supply? Prices go up. Funding increased government spending by credit created out of thin air by the Fed and the banking system, or dropping money from a helicopter, does, indeed, stimulate aggregate nominal spending. This might be a good idea when there has been a negative shock to demand, but not such a good idea when there has been a negative shock to supply.

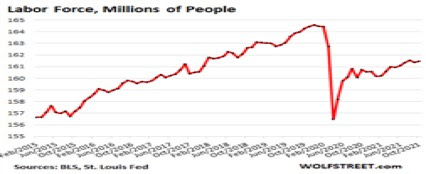

Recall that the Covid lock-downs caused the labor force to shrink dramatically.

Fewer workers means that fewer goods and services were being produced at the same time that people were receiving large stimulus checks. This led to a dramatic increase in consumption of (largely imported Chinese) goods from Walmart and Amazon as shown here.

Econ 101: Fewer goods and rising demand always lead to rising prices.

The increase in producer prices ensures continuing rising retail prices.

Finally, we have rising wages. All input costs (labor, materials, taxes), must be passed on to the consumer or the producer eventually goes out of business.

Venezuelans have faced the consequences of their government’s endless money printing for decades. This socialist workers’ paradise recently lopped six zeros from its currency, the Bolivar. The former highest denomination note of 1,000,000 Bolivars was worth less than $0.25. The new highest denomination note, the 100 Bolivar, was worth about $25.00. This became necessary after the price of a loaf of bread had risen to 27 million old Bolivars. Of course, the new currency can be printed just as readily as the old. Thus, the new Bolivar has already lost 73% of its value in 2021 alone. Brazil’s price inflation rate is 10.2%; Argentina’s is 52%. Profligate money printing always ends in tears. Take note Jay Powell.

As pointed out above, not everyone is hurt by rampant money printing. David Stockman reports,

As it happened, 21.3 million Americans employed last year (out of 167.6 million total) earned less than $5,000 during the entire year and, in fact, an average of only $2,127. Goldman Sachs announced that it awarded its top two executives, CEO David Solomon and president John Waldron, one-time stock bonuses of $30 million and $20 million. As the Wall Street Journal further explained,

If the bank were to hit the top targets, Mr. Solomon’s bonus would be worth more than $50 million and Mr. Waldron’s bonus would be worth more than $35 million.

Let’s see. At the top-tick, those Goldman bonuses would equal the annual earnings of 40,000 of the above mentioned wage workers! Goldman’s LTM [last twelve months] revenues grew from $35.7 billion to $36.5 billion. That’s a growth rate of, well, 0.17% per annum, and is most definitely not in the “geniuses at work” category.

But after the nation got socked with Fauci, lockdowns, soaring unemployment and a bacchanalia of stimmies, Goldman’s LTM revenues rose to $60.2 billion for the September 2021 period. That’s 20% per annum growth rate or 120X its pre-Covid trend.

Of course, it wasn’t some kind of entrepreneurial Geritol that put a sprint back into the revenues of Goldman Sachs. To the contrary, it was the near $5 trillion of Fed money-printing since the fall of 2019 that did the trick.

And it is not just the Vampire Squids at Goldman raking in fortunes while workers were laid-off by the millions and the national economy cratered. Bill Bonner explains why,

The elites control the government. The government controls the printing press. Is it any surprise where the printing-press money goes? Business Insider reports that the wealthiest Americans now own most of the stock market:

The top 10% of Americans now hold 89% of corporate equities and mutual fund shares, a record high.

The top 1% alone holds over half of stocks owned by households, according to the Federal Reserve.

That means the wealthiest Americans disproportionately profited from the stock market’s strong performance over the last year.

Here’s more evidence from OpenSecrets.org that the corruption is deep… and bipartisan:

House Speaker Nancy Pelosi (D-Calif.) has seen her wealth increase to nearly $115 million from $41 million in 2004, the first year OpenSecrets began tracking personal finances. Senate Majority Leader Mitch McConnell (R-Ky.) saw his net worth increase from $3 million to over $34 million during that time.

And here’s the chief of the money-printers himself, Jerome Powell. The Federal Reserve head attended Georgetown Law Center at the same time we did (though we don’t recall him). Now, after years of apparently trading on the Fed’s “inside information,” he is worth up to $55 million.

It was recently reported that two other Fed officials were raking it in during the crisis. The presidents of the Fed’s Dallas and Boston regions abruptly resigned after it was disclosed that they were making million-dollar bets on the market at the same time they were voting on official Fed policy. No one possesses more “insider information” than Fed officials about what the Fed is about to do. The Department of Justice should investigate and seek to forfeit their gains.

The inevitable result of the Fed’s money printing (inflation of the money supply) to fund Congress’ largess is rising prices. The flip side of that same coin is the dollar’s loss of purchasing power, pictured here from just 2012.

The world economies remain dependent on quantitative easing (printed money) and low interest rates. A surfeit of both have had predictable results: lots of money chasing returns. Tesla is a good example. It has a market cap (share price x number of outstanding shares) equal to the ten largest automakers combined. Its production of vehicles is minuscule by comparison.

Central bank money printing fueled today’s equity bubbles and the related surge in prices of goods and services. The Telegraph’s Ambrose Evans-Pritchard spells out the metastasizing effect that is having on the industrial engine of the EU.

Inflation is particularly corrosive in Germany, not because of Weimar mythology but because just half the population owns property or equities. The other half rents for life and mostly keeps savings in bank deposit accounts. This half is being pauperised. Furthermore, negative rates are destroying the business model of the small cooperative and savings banks that provide 90pc of credit for the Mittelstand family firms, the backbone of the German socio-economic system. There is a suspicion that QE is being used to fund German credits to southern Europe by stealth through the ECB’s Target2 payments nexus, with no democratic legitimacy and beyond the Bundestag’s budgetary oversight.Germany’s Target2 credits [what other national banks owe the German national bank] have reached €1.1 trillion. The liabilities of Italy and Spain together exceed €1 trillion. The ECB says this is a mechanical side-effect of QE, but that is precisely the problem. Germany is being drawn deeper into a trap where it stands to lose ever-larger sums if the monetary union breaks apart and Target2 debts are crystallized.Events are nearing the point where Germany must either challenge this process or accept that it has lost control of the euro, and forever hold its peace.Excess liquidity is in any case causing ever more surreal mispricing in asset markets. Last week the unthinkable finally happened: average real yields on European corporate junk bonds fell below zero for the first time. Yet the euro remains fundamentally dysfunctional, without a fiscal union or a genuine banking union to back it up, held together by bond purchases on the stretched margins of EU treaty law. Tapering could be a rude awakening.

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

The Climate Confab

Here was another example of stupid. The world’s political and corporate “elite” gathered at the COP26 climate summit in Glasgow to decry the rise in global carbon dioxide output. The media breathlessly hung on and reported their every word. Most viewers of the “nightly news” were oblivious to the rank hypocrisy. These world improvers flew in on over four hundred private jets in order to pontificate on how you need to lower your standard of living in order to reduce our collective energy consumption. Hypocrite-in-chief was Joe Biden. He is believed to have created 2.2 million pounds of carbon as he brought along four planes, the Marine One helicopter, his 20,000-pound armored Cadillac (called the “Beast”) and a throng of lackies. His contribution? A brief speech of platitudes. John Kerry, America’s “Climate Envoy” has reportedly taken sixteen trips this year on his “family jet.” On a similar note, Jeff Bezos failed to consider the “carbon load” of his vanity flight into space. Yet these same people seek to shame us into lowering our thermostats this winter and bicycling to work.

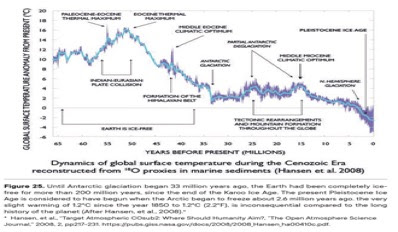

The moving force behind the climate change debate began with Al Gore’s famous “hockey stick” graph that purported to show the earth’s average temperatures vacillating mildly up to the industrial revolution and then abruptly rising higher -like a hockey stick on its side.

Many studies challenge the argument that the world has never been hotter and never suffered so much CO2. Available evidence shows that prior epochs had dramatically higher levels of CO2 and were far hotter.

Of course none of the above means that we should continue to foul our own nest. But it does mean we need to think rationally and not give in to the strident demands of dyspeptic adolescents. The use of stored solar energy (coal, oil and gas) has lifted humankind out of subsistence living, vastly improving the lives of billions of people. World GDP hovered just above “zero” from the dawn of our species until the mid-1800’s at which point it has soared to over $200T. What was the trigger for that amazing advance? The use of carbon energy forms.

The world gets 83% of its energy from fossil fuels. The practical fact is that we cannot quit carbon energy cold turkey before the widespread implementation of alternate energy sources without returning to our subsistence-farmer status quo ante. A modern tractor can till more land in five minutes that a farmer behind a mule can do in several days. Thus, we are able to feed six billion people.

It is increasingly obvious that wind and solar energy will aid us but are not the solution. They are episodic as the Brits recently learned when their off-shore wind farms unexpectedly fell silent. We need a reliable energy base load or factories will shut down - as is happening in China today – food and goods will not be delivered to stores and our homes will go cold. We need to be especially skeptical of the rantings of politicians of all stripes for the reason that they do not know what they are talking about and everything they do and say is politically motivated. They are not experts on anything and are merely parroting what someone else - with an unknown agenda - has told them.

The Ongoing Covid Crisis

Do you recall when President Biden insisted that people get the recently developed vaccination against Covid. He said, “If you get vaccinated you will not get the virus and you cannot pass it on to others.” That was utterly false. Vaccinated people still get the virus (“breakthrough cases”) and can pass on the virus to others. He did not know what he was talking about. We urge you to take medical advice from politicians as readily as you would take it from your plumber (and we mean no offense to them). You need to discuss important medical issues with your trusted personal physician.

This raises the question of whether you should take health advice from “experts” who have no personal relationship to you. Recall that Dr. Fauci first told us that wearing a facemask was useless against the virus. He finally admitted that he had lied so that masks would not become scarce for health care workers. He later said that the National Institutes for Health never supplied any funding that was used in Wuhan China to do “gain of function” research for Covid (make it more dangerous). It now appears that US tax dollars were indeed used at the Wuhan lab for that dangerous research. He has no credibility.

Recall the insistent demands from politicians, the media, friends and neighbors that we “listen to the science” about Covid. The problem, of course, is that there is no such thing as “the science.” Rather, there are scientists who have opinions. We were led to believe that scientists were in uniform agreement about what should be done. That was not true. Highly regarded scientists were not in agreement about such things as the necessity of lockdowns. Prominent experts from Stanford University and other highly regarded institutions feared (rightly so in hindsight) that locking people down would lead to massive mental and physical health problems. The UK’s national health service is just now counting the death toll from people who were unable to seek diagnosis and treatment for their conditions for over a year and a half. Infectious disease epidemiologists and public health scientists voiced similar concerns in their Great Barrington Declaration. Their voices were “cancelled” by political and media group-think.

It is now known that more than 11,000 people caught Covid and died after being admitted to the UK’s NHS hospitals for other ailments. Clearly, the sick, elderly and immune-compromised should have been the focus of the medical community’s attention. The young were never at much risk.

Infection Fatality Rates By Age Cohort From CDC Data:

Officialdom told us that vaccination was the means to defeat the virus. That too was false. Despite mass vaccinations, there are new surges around the world. Ireland is 93% vaccinated and suffers a new surge. Gibraltar is 100% vaccinated and is about to engage in a lockdown. Austria has just locked down again. Vaccinations are nevertheless useful in reducing the severity of cases but the virus is likely to join the seasonal flu as an ongoing health challenge for the old and the infirm. It does what viruses do best: it mutates readily. We must learn to live with it because we cannot endlessly hide in our homes. We are not anti-vaxxers and dutifully submitted to the jabs. We just did not believe the hype that the vaccines were the panacea they were held out to be.

© All rights reserved 2021

Important Message: The foregoing is not a recommendation to purchase or sell any security or asset, or to employ any particular investment strategy. Only you, in consultation with your trusted investment advisor, can select the strategy that meets your unique circumstances, investment objectives and risk tolerance.